What is a stocks and shares ISA?

A stocks and shares ISA is a tax-efficient investment account in the UK that allows you to invest up to £20,000 per tax year in shares, funds, bonds, and other assets without paying income tax or capital gains tax on the returns. This makes it one of the best stocks and shares ISA options for building long-term wealth, as your profits grow sheltered from HM Revenue & Customs (HMRC) taxation. For the 2025/26 tax year, the ISA allowance remains £20,000, enabling tax-free investments in stocks and shares ISAs, according to official guidance from HMRC.

Unlike a cash ISA, which offers savings-like returns with lower risk but minimal growth, a stocks and shares ISA involves market investments that can fluctuate, potentially delivering higher returns over time but with greater volatility. Eligibility requires you to be a UK resident aged 18 or over, and you can hold multiple ISAs as long as the total contributions do not exceed the annual limit. Key benefits include shielding dividends and gains from tax, which is particularly valuable if you’re in a higher tax bracket, and the flexibility to transfer between providers without losing tax status.

Top stocks and shares ISA providers in 2025

The best stocks and shares ISA providers in 2025 balance low fees, wide investment choices, and user-friendly platforms, with Hargreaves Lansdown leading for comprehensive services despite higher costs. Hargreaves Lansdown serves over 1.9 million clients with average fund fees of 0.45% in 2025, praised for its research tools and 3,000+ investment options, as per an independent survey by Which?. Vanguard stands out for cost-conscious investors with passive index funds, while Freetrade appeals to beginners via its app-based, commission-free trading.

Other notable platforms include Interactive Investor for flat fees and AJ Bell for balanced costs. To compare, consider factors like minimum investments and customer ratings. Here’s a table outlining top providers:

| Provider | Annual fee (%) | Min investment | User rating (out of 5) |

|---|---|---|---|

| Hargreaves Lansdown | 0.45 | £100 | 4.5 |

| Vanguard | 0.15 | £500 | 4.2 |

| Freetrade | 0 (custody fee) | £1 | 4.4 |

| Interactive Investor | Flat £4.99/month | £25 | 4.3 |

| AJ Bell | 0.25 | £500 | 4.1 |

This comparison draws from reviews by MoneySavingExpert and Which?, highlighting the best platform for stocks and shares ISA based on fees and features. For more details on fee breakdowns, see MoneySavingExpert’s guide to stocks and shares ISAs.

Tip: Start small

If you’re new, opt for providers with no minimum investment like Freetrade, which offers commission-free trades with a 0.25% FX fee for international shares in 2025. This allows testing the waters without commitment.

Best for beginners and managed ISAs

For beginners, the best stocks and shares ISA for beginners is one with ready-made portfolios and low fees, such as Nutmeg or Wealthify, where experts manage investments to match your risk tolerance. These managed stocks and shares ISAs handle diversification—spreading investments across assets to reduce risk—for a fee around 0.25-0.75%, ideal if you prefer hands-off growth. Platforms like Vanguard also offer simple index funds that track markets like the FTSE 100, delivering steady exposure without daily decisions.

Risk levels vary: low-risk options focus on bonds and global equities for 3-5% annual returns, while higher-risk ones target 7%+ but with potential short-term losses. Top picks include the best managed stocks and shares ISA UK from providers rated highly for customer service. Remember, past performance isn’t a guarantee, and investing involves risk of capital loss—this isn’t financial advice.

Performance and top funds for maximum returns

The best performing stocks and shares ISA in 2025 could yield 7-9% annually, outperforming cash ISAs, with funds like Vanguard LifeStrategy achieving 7.2% average 5-year returns as of August 2025, benchmarked against the FTSE All-Share. The FTSE 100 index returned 8.5% annually over the last five years to 2025, setting a strong baseline for UK-focused investments, per data from Money To The Masses. For maximum returns, consider diversified funds such as global equity trackers or emerging market portfolios, but balance with your risk appetite.

Recommended best stocks and shares ISA funds include:

- Vanguard FTSE Global All Cap Index: Low-cost, broad exposure.

- Legal & General UK Index Trust: Tracks FTSE 100 for steady growth.

- BlackRock MyMap 5: Managed, moderate risk with 6.8% 5-year returns.

Focus on long-term holding (5+ years) to weather volatility. For historical insights, check Kepler Trust Intelligence’s 2025 provider review.

Junior and lifetime ISA options

The best junior stocks and shares ISA for children’s future savings is from providers like Hargreaves Lansdown or Freetrade, offering tax-free growth until age 18 with annual limits of £9,000. These accounts suit parents seeking the best junior ISA stocks and shares, emphasizing ethical or index funds for compounding returns over 18 years. Performance-wise, top options mirror adult ISAs but with lower minimums, potentially growing £9,000 annually to over £300,000 by maturity at 7% returns.

For first-time buyers, the best stocks and shares lifetime ISA combines investment with a 25% government bonus on up to £4,000 yearly, capped at £20,000 total allowance. Providers like Moneybox excel here, blending stocks for growth toward home deposits. Link to deeper guides on junior options for family planning, but always assess suitability.

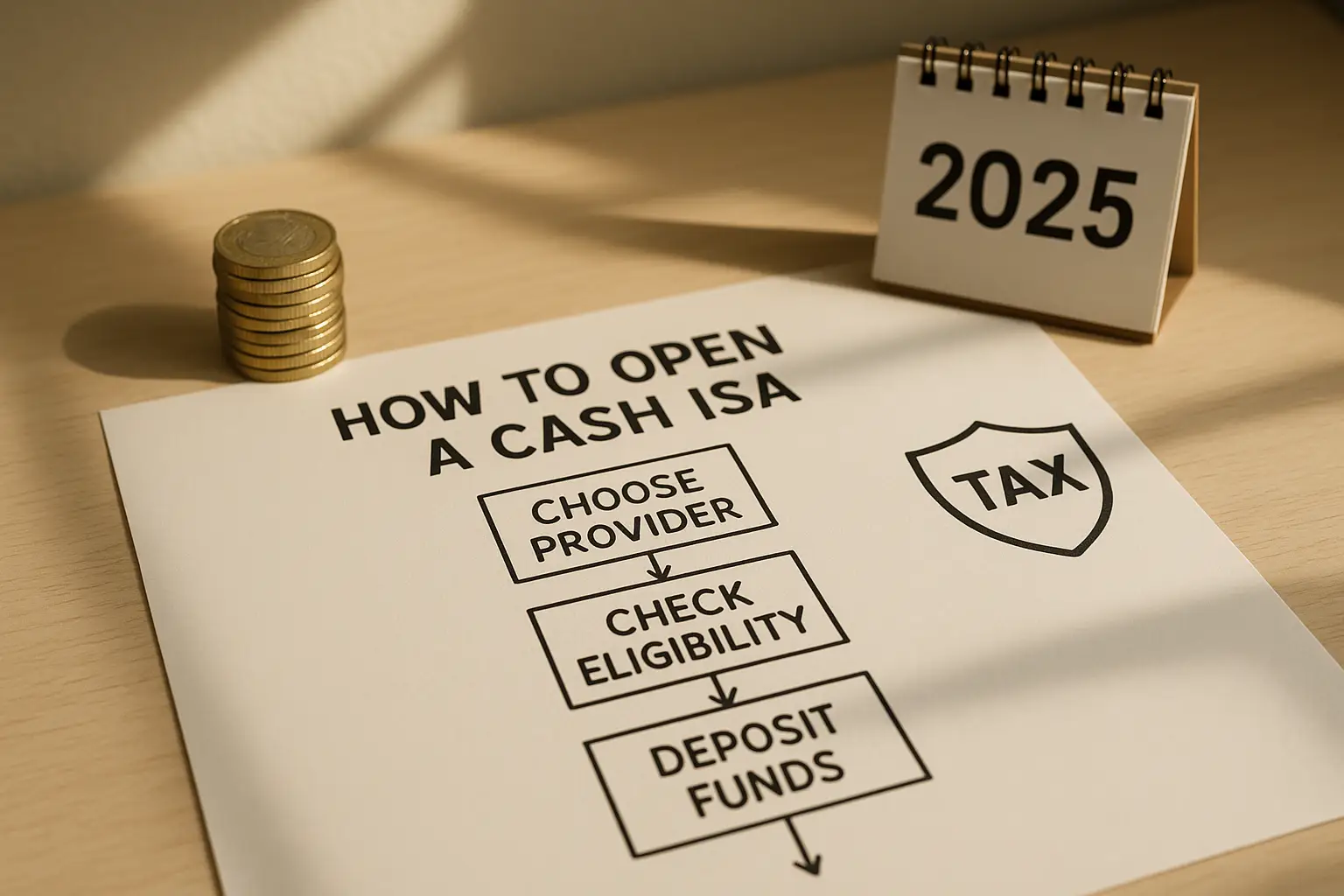

How to choose and open an ISA

Choose the best stocks and shares ISA by comparing fees, investment variety, and app usability—prioritize platforms under 0.25% annual charges for cost efficiency. Evaluate via independent sites like Which? for ratings, and consider transfers if switching; you can move existing ISAs without tax penalties, preserving wrapper status. Common pitfalls include exceeding the £20,000 allowance or ignoring exit fees—always read terms.

To open:

- Research providers using tools from MoneySavingExpert.

- Verify eligibility on the HMRC site.

- Apply online, providing ID and funding via bank transfer.

- Monitor via the app and diversify early.

For transfer guidance, consult Which?’s stocks and shares ISA finder.

Frequently asked questions

What is the best stocks and shares ISA for beginners?

The best stocks and shares ISA for beginners is Freetrade or Vanguard, offering low or no fees and simple app interfaces for easy entry into investing. These platforms provide ready-made funds that diversify across global markets, reducing the overwhelm of picking individual shares. Start with a low-risk portfolio to learn without high exposure, but remember to assess your financial goals and seek independent advice if needed.

Which provider has the best performing stocks and shares ISA?

Hargreaves Lansdown often tops for performance due to its vast fund selection, with average returns exceeding benchmarks like the FTSE 100’s 8.5% over five years. However, the best performing stocks and shares ISA depends on your strategy—active funds may outperform in bull markets, but passive ones like Vanguard’s are more consistent long-term. Track 2025 updates via Kepler Trust Intelligence, noting that volatility can erase gains quickly.

How much can I invest in a stocks and shares ISA in 2025?

You can invest up to £20,000 in a stocks and shares ISA for the 2025/26 tax year, the same as the overall ISA allowance set by HMRC. This covers all ISA types combined, so split wisely between cash and stocks if desired. Unused allowance doesn’t roll over, so maximize it for tax-free growth, but only invest what you can afford to lose.

What are the best performing ISA funds?

Top performing ISA funds in 2025 include Vanguard LifeStrategy 80% Equity at 7.2% five-year returns and Fidelity Index World for global diversification. These outperform many peers by tracking indices with low costs, ideal for the best stocks and shares ISA funds seeking steady gains. Compare via Morningstar data, but diversify to mitigate sector-specific risks like tech downturns.

What’s the difference between a cash ISA and a stocks and shares ISA?

A cash ISA offers guaranteed, low-risk returns like a savings account with tax-free interest, typically 3-5% in 2025, while a stocks and shares ISA invests in markets for potential higher returns but with capital risk. Cash suits short-term needs, whereas stocks and shares excel for long-term goals like retirement. Choose based on tolerance—many use both within the £20,000 limit for balanced saving.

Can I transfer my stocks and shares ISA to another provider?

Yes, you can transfer your stocks and shares ISA to the best stocks and shares ISA provider for better fees or options without losing tax benefits, as long as it’s to another UK-approved platform. The process takes 15-30 days and can be done online or via form, with no impact on your allowance. Avoid cashing out to prevent tax exposure, and check for transfer fees upfront.

This article is for informational purposes only and not financial advice. Investing carries risk, and you may get back less than invested. Consult a professional advisor.