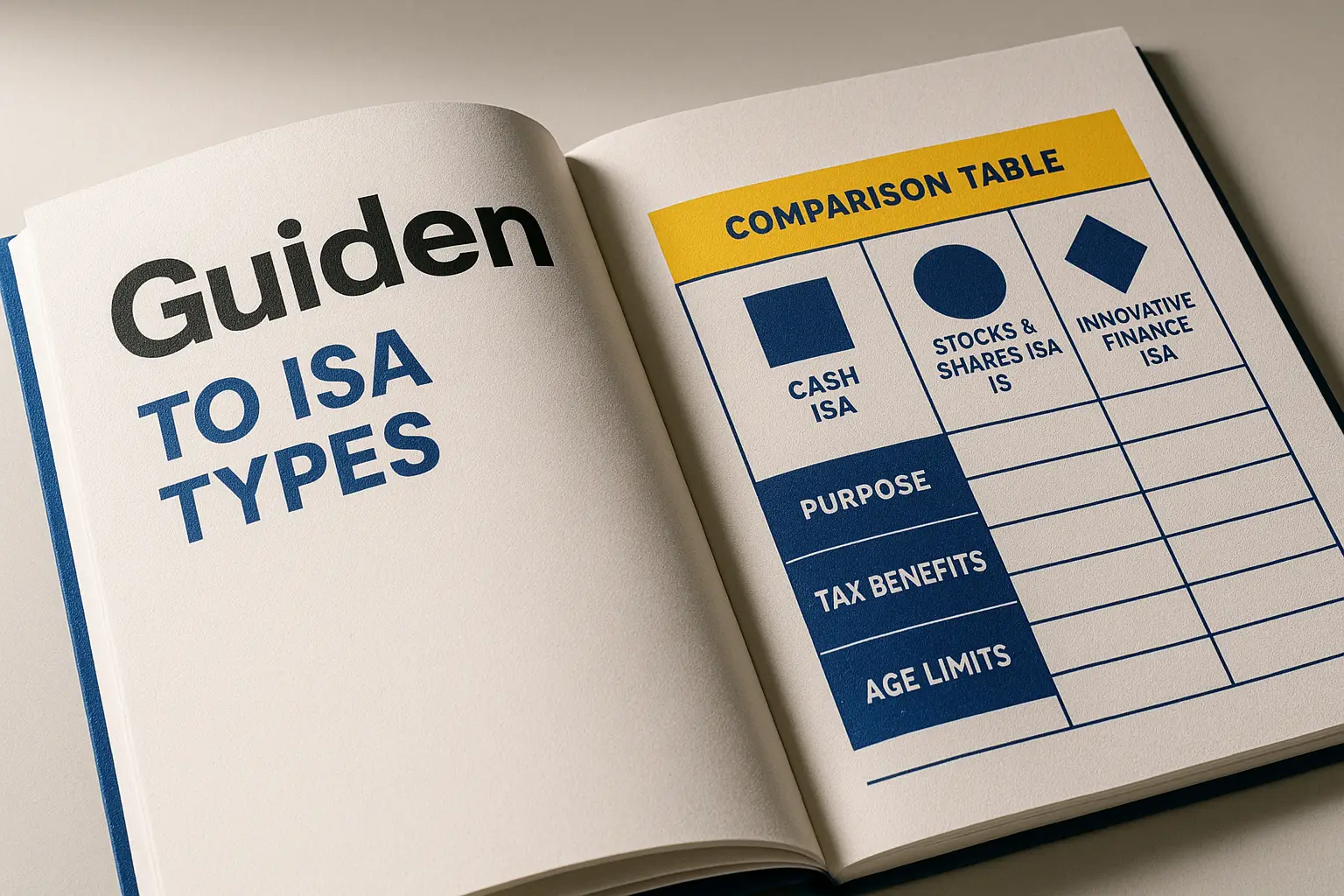

Understanding ISA types and rates

Individual Savings Accounts, or ISAs, allow UK residents to save or invest up to £20,000 tax-free each tax year. When you compare ISA rates, focus on the Annual Equivalent Rate (AER), which shows the true return including compounding interest. Cash ISAs suit low-risk savers, while fixed rate options lock in yields for stability.

Cash vs fixed rate ISAs

Cash ISAs offer flexibility with easy access to funds, ideal for short-term needs, but rates can fluctuate. Fixed rate ISAs provide guaranteed returns over terms like one or five years, protecting against base rate cuts, though withdrawals often incur penalties. Comparing cash ISA rates UK reveals easy access products topping 4.51% AER, per Moneyfactscompare.co.uk data from October 2025.

Junior and lifetime ISA overviews

Junior ISAs help parents save for children under 18, with rates around 4% AER for cash versions. Lifetime ISAs target first-time buyers or retirees aged 18-39, offering a 25% government bonus on contributions up to £4,000 annually. When you compare junior ISA rates, note tax-free growth until age 18; lifetime options compare favourably to cash ISAs for long-term goals but penalise non-qualifying withdrawals.

Factors influencing rates

The Bank of England base rate, currently at 5%, drives ISA yields, but competition among providers like HSBC and Nationwide varies offers. Inflation erodes real returns, so compare ISA interest rates against the 2% target. Eligibility, such as UK residency and minimum deposits from £1 to £5,000, also affects choices.

Top cash ISA rates comparison

Current top cash ISA rates hit 4.51% AER for easy access, surging usage to £70 billion in 2023/24 as savers chased yields amid high inflation, according to MoneyWeek.

Easy access options

These allow withdrawals without notice, suiting emergency funds. Providers like Plum and Chip offer competitive compare cash ISA rates, often above 4% AER with no minimums. Instant access beats fixed for liquidity but may lag in locked yields.

Fixed term cash ISAs

For stability, one-year terms reach 4.28% AER, per Moneyfactscompare.co.uk’s 1-year fixed rate ISAs page. Longer terms like two years yield slightly less but secure against drops.

Provider breakdown

| Provider | Rate (AER) | Term | Min Deposit | Eligibility |

|---|---|---|---|---|

| Nationwide | 4.51% | Easy Access | £1 | UK residents 18+ |

| HSBC | 4.27% | 1 Year Fixed | £500 | Existing customers |

| Yorkshire Building Society | 4.28% | 1 Year Fixed | £100 | UK only |

| Leeds Building Society | 4.20% | Easy Access | £1 | All UK adults |

| Moneybox | 4.92% | Variable | £500 | App-based, 18+ |

This table highlights top picks; rates from Moneyfactscompare.co.uk, accessed October 2025. For details on Nationwide cash ISA rates, check provider sites.

Tip: Always verify FSCS protection up to £85,000 per provider for security when comparing ISA savings rates.

Fixed rate ISA comparisons

Fixed rate ISAs lock funds for predictable returns, outperforming variable rates in falling markets.

1-year fixed rates

Topping 4.28% AER, these suit one-year horizons. Compare fixed cash ISA rates across 100+ providers on Moneyfacts’ fixed rate ISAs for options like 4.27% from building societies.

Longer-term yields

Two- to five-year terms offer 3.5-4% AER, balancing commitment with returns. Compare fixed rate ISA interest rates shows diminishing premiums for longer locks.

Penalty and withdrawal rules

Early access typically loses 90-180 days’ interest; some allow partial withdrawals. Review terms to avoid surprises.

Specialist ISAs: Junior and lifetime rates

Beyond standard cash, specialist ISAs target families and future planners. UK ISA holders fell 2.4% in 2024/25, yet average balances rose to £34,044, per GOV.UK statistics.

Junior ISA providers

Compare junior ISA interest rates yield 4% AER cash options from Santander or Trading 212. Contributions up to £9,000 yearly grow tax-free.

Lifetime ISA bonuses and rates

Rates mirror cash ISAs at 4-4.5% AER, plus 25% bonus. Compare lifetime ISA rates favour them for home buys over standard cash for qualifying uses.

Best for over-60s

Seniors access similar rates, with some providers like Santander offering compare ISA rates for over 60s at 4.2% AER. Link to our ISA allowance 2025 guide for rules.

For more on types of ISA accounts, explore further.

How to compare and switch ISA rates

Use tools to find the best; sites like MoneySavingExpert list top deals.

Using comparison tools

Input amount and term on platforms to compare ISA rates UK. Martin Lewis’ best cash ISA guide recommends filtering by AER and fees.

Transfer process

Transfers are free within 30 days; instruct your old provider to move to a new one. Yes, you can transfer for better rates without losing tax benefits.

Tax and allowance tips

£20,000 annual limit across all ISAs; unused rolls over. See best ISA rates UK for updates. This is not financial advice; consult professionals.

- Check eligibility first.

- Compare AER, not headline rates.

- Monitor base rate changes.

Current market trends and 2025 outlook

Rates peaked post-2022 hikes but face cuts.

Impact of base rate cuts

BoE reductions from 5.25% pressure yields downward; expect 4% averages by mid-2025.

Historical vs current rates

From 1% in 2021 to 4.5% now, per Which? analysis. Compare ISA rates 2025 projections show stabilisation.

Inflation considerations

With CPI at 2.2%, real returns stay positive; prioritise tax-free growth over non-ISAs.

For the latest, visit Moneyfacts’ weekly ISA roundup.

Frequently asked questions

What is the best cash ISA rate right now?

Top easy access cash ISA rates stand at 4.51% AER as of October 2025, offered by providers like Nationwide and specialist online banks. These outperform regular savings due to tax-free interest, protecting up to £1,000 annually for basic-rate taxpayers. Always compare cash ISA rates UK on trusted sites like Moneyfacts for daily updates, considering minimum deposits and access terms to match your needs.

How do I compare ISA rates online?

Start with aggregator sites entering your deposit amount, preferred term, and access needs to filter options. Tools from MoneySavingExpert or Which? provide side-by-side views of AER, fees, and FSCS coverage. For accurate comparisons, cross-check provider sites, as rates change frequently; focus on compare ISA interest rates to ensure tax efficiency in your strategy.

What are the top fixed rate ISAs for 2025?

One-year fixed ISAs lead at 4.28% AER, with longer terms slightly lower at 3.8-4.2% from building societies like Leeds. These lock in yields amid expected base rate falls, ideal for risk-averse savers. Compare fixed rate ISA rates considering penalties, as early withdrawal could erode gains; projections for 2025 suggest stability if inflation eases.

Are ISA rates better than regular savings?

Yes, ISAs offer tax-free growth, shielding interest from 20-45% tax, unlike standard accounts under the £1,000 personal allowance. For example, 4% on £10,000 yields £400 tax-free versus £320 after basic-rate tax. However, regular savings may suit small pots; compare ISA savings rates when exceeding allowances to maximise returns without HMRC deductions.

How does a lifetime ISA compare to a cash ISA?

Lifetime ISAs provide a 25% government bonus on savings, boosting effective rates beyond standard cash ISAs’ 4-4.5% AER, but limit uses to homes or retirement. Cash ISAs offer full flexibility without age or purpose restrictions. For 18-39-year-olds, compare lifetime ISA rates if buying property; otherwise, cash versions suit general saving amid 2025 rate trends.

What are junior ISA rates for 2025?

Junior cash ISAs average 4% AER, with top providers like Santander hitting 4.2% for flexible access until age 18. Parents contribute up to £9,000 yearly tax-free, compounding for future needs. Compare junior ISA rates focusing on long-term growth; stocks and shares variants risk capital but potentially yield more, per HMRC guidelines.

Can I transfer my ISA to get a better rate?

Yes, transfers to higher-rate ISAs preserve tax status and are fee-free if done correctly within the same tax year. Instruct your current provider to move funds, typically completing in 15-30 days. This strategy boosts yields, especially post-rate changes; review compare ISA rates for over 60s or families to optimise without losing allowance.

What affects ISA interest rates in the UK?

Base rate decisions by the Bank of England primarily influence rates, alongside provider competition and economic factors like inflation. Global events, such as energy prices, indirectly impact via policy responses. When you compare best ISA rates, monitor BoE announcements; 2025 forecasts predict modest falls, making timely switches key for savers.

In summary, comparing ISA rates empowers better financial decisions. With yields up to 4.92% in 2025, act now to secure tax-free growth. For personalised advice, consult a financial expert or visit Which?’s best cash ISA guide.

This article provides general information and is not financial advice. Rates are subject to change; verify with providers.