What is a Junior ISA and How Does It Work?

A Junior ISA is a tax-efficient savings account designed specifically for children under 18 in the UK, allowing parents or guardians to save on their behalf with growth shielded from taxes. This means any interest or gains accumulate without deductions until the child reaches 18, when they gain control of the funds. To understand the full picture of junior ISA tax benefits, it is essential to grasp the basics of how these accounts operate.

Eligibility and setup

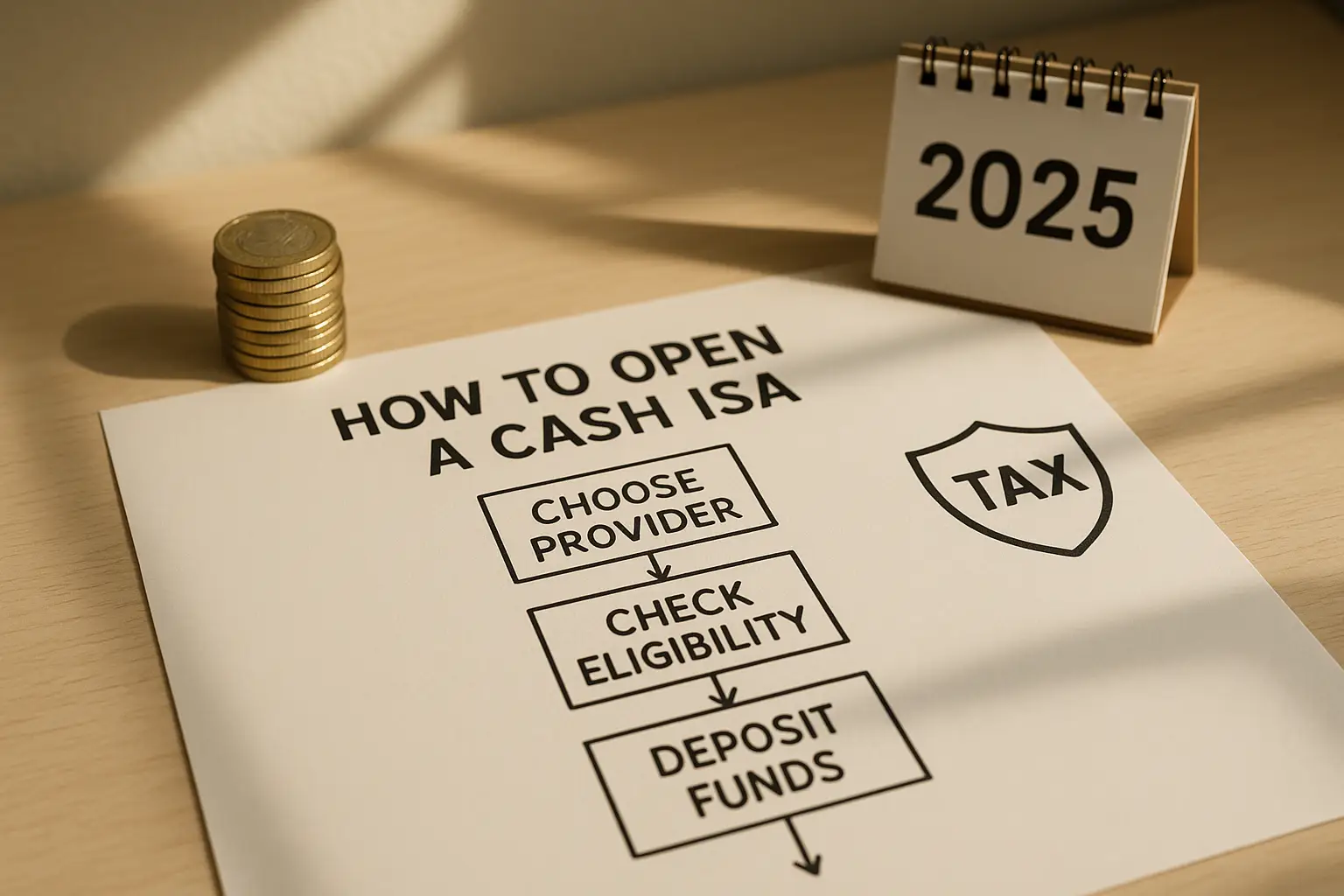

Any child resident in the UK under 18 who does not already have a Child Trust Fund qualifies for a Junior ISA. Parents, guardians, or family members can open the account online or via a provider regulated by the Financial Conduct Authority (FCA), often starting with a minimum deposit as low as £1. Setup is straightforward, but only one Junior ISA per child is permitted at a time, though transfers between providers are allowed to chase better rates.

Cash vs stocks and shares options

Junior ISAs come in two main types: cash versions, similar to a regular savings account offering steady interest, and stocks and shares versions that invest in funds, shares, or bonds for potentially higher returns. The cash option suits risk-averse savers, providing up to 4.4% tax-free interest in 2025 according to Which?, while stocks and shares can deliver greater growth but with market volatility. Choosing between them depends on your risk tolerance and long-term goals for the child’s future.

Access and withdrawal rules

Funds in a Junior ISA cannot be withdrawn until the child turns 18, ensuring long-term savings discipline. At maturity, the account converts to an adult ISA, maintaining tax-free status, or the child can take the money out. This locked-in structure maximises junior ISA tax benefits by preventing early access that could trigger taxes elsewhere.

Key Tax Benefits of Junior ISAs

The primary appeal of junior ISAs lies in their complete exemption from UK taxes on interest, dividends, and capital gains (CGT, which taxes profits from asset sales), potentially saving thousands over 18 years compared to taxable accounts. These benefits apply solely to the child’s funds, with no impact on the parents’ tax liability. For those wondering what are the tax benefits of a junior isa, they centre on shielding growth from income tax and CGT until adulthood.

Income tax exemption

Interest earned in a Junior ISA cash account is entirely tax-free, unlike standard children’s savings where interest over £100 per year (from parental gifts) is taxed as the parent’s income under HMRC rules. This exemption is crucial for higher-rate taxpayers, as it avoids pushing contributions into taxable brackets. As outlined by MoneySavingExpert, this setup ensures every penny of interest compounds without deductions.

Capital gains tax savings

In stocks and shares Junior ISAs, any profits from investments escape CGT, which stands at 10-20% for most adults on gains above the £3,000 annual allowance. Over time, this can significantly boost the pot; for example, a £50,000 gain would save £5,000-£10,000 in taxes. These junior ISA tax benefits make them ideal for long-term wealth building.

Inheritance tax considerations

While not directly exempt from inheritance tax (IHT), Junior ISAs can reduce IHT liability since contributions count as potentially exempt transfers, becoming IHT-free if the child survives seven years after gifting. This adds a layer of estate planning efficiency for grandparents or parents.

Junior ISA Allowance and Limits for 2025/26

For the 2025/26 tax year, the annual Junior ISA allowance remains £9,000, covering both cash and stocks and shares contributions combined. This limit, set by HMRC, allows tax-free deposits up to that amount each year from birth until the day before the child’s 18th birthday. Strategic use of this allowance is key to unlocking the full junior ISA tax benefits.

Current allowance details

The £9,000 cap applies per tax year (6 April to 5 April) and is unchanged from previous years, as confirmed by Hargreaves Lansdown. Unused allowance does not roll over, so maximising it annually is advisable for compound growth.

Contribution strategies

Spread contributions monthly to average costs in stocks and shares options, or lump sum for cash to lock in rates. Anyone can contribute, including family, but total gifts from parents may affect their own tax if exceeding allowances—though no direct tax relief on Junior ISA deposits exists.

Transfers from CTFs

Children born between 2002 and 2011 may have a Child Trust Fund (CTF), which can be transferred to a Junior ISA for continued tax-free growth. In 2024-25, around 415,000 CTFs matured with an average value of £2,242, many moving to Junior ISAs per GOV.UK statistics, preserving benefits without new contribution limits.

Quick tips for Junior ISA contributions

- Start early to maximise tax-free compounding.

- Review rates annually via Which?’s best Junior ISA rates guide.

- Consider diversifying between cash and shares for balanced risk.

Maximizing Tax-Free Growth: Tips and Examples

To maximise junior ISA tax benefits, contribute the full £9,000 yearly and select options with strong historical returns, potentially growing £162,000 in contributions to over £300,000 in 18 years at 5% average growth, all tax-free. Avoid early withdrawals, which are not permitted anyway, and monitor for transfers to better providers.

Projected returns

Assuming 4.4% fixed cash interest, a £9,000 annual contribution could yield £250,000 by age 18, versus £220,000 in a taxable account after 20% tax on interest (based on HMRC rates). Stocks and shares might double that with 7% returns, but past performance is not a guarantee.

Common pitfalls

Overlooking the single-account rule can lead to invalid contributions, and ignoring fees in stocks options erodes benefits. Parents should not treat it as their own savings, as control passes at 18.

Comparison to non-ISA savings

| Feature | Junior ISA | Standard Children’s Savings |

|---|---|---|

| Annual Allowance | £9,000 tax-free | Unlimited, but interest taxed |

| Tax on Interest | None | Parent’s rate on £100+ from gifts |

| CGT on Gains | Exempt | Applies if child has income |

| Example 18-Year Growth (£9k/yr at 4%) | ~£240,000 tax-free | ~£210,000 after tax |

For more on setup, see our guide on how to open a junior isa. Compare options in our best junior isa overview.

Latest Statistics and Trends in Junior ISAs

Junior ISAs continue to grow in popularity, with transfers from maturing CTFs driving uptake amid rising interest rates. Official data shows a shift towards tax-efficient children’s savings.

Usage data

Over 1.5 million Junior ISAs hold £12 billion in assets as of 2025, per Interactive Investor, reflecting parents’ focus on tax-free growth.

Maturity insights

With 415,000 CTFs maturing in 2024-25 at an average £2,242 each, many families are opting for Junior ISAs to extend benefits, as reported by GOV.UK.

2025 rate highlights

Top cash Junior ISAs hit 4.4% AER, outpacing inflation and taxable alternatives, while stocks options average 6-8% long-term. For details, check Hargreaves Lansdown’s allowance guide or GOV.UK savings statistics.

Frequently asked questions

How much can I put in a Junior ISA in 2025?

The annual allowance for a Junior ISA in 2025/26 is £9,000, covering the tax year from 6 April 2025 to 5 April 2026. This can be split between cash and stocks and shares types, but totals must not exceed the limit to maintain tax-free status. Contributing the maximum each year harnesses the full junior ISA tax benefits, allowing significant growth without tax erosion, as confirmed by HMRC via providers like Interactive Investor.

When can my child access the money?

Children can access Junior ISA funds only on their 18th birthday, at which point the account automatically converts to an adult ISA or allows withdrawal. Until then, parents manage it, but early access is impossible, promoting disciplined saving. This structure ensures long-term tax-free growth, with the child then deciding on continued investment or cashing out.

What’s the difference between cash and stocks and shares Junior ISAs?

Cash Junior ISAs offer guaranteed interest like a savings account, ideal for low risk, while stocks and shares involve investments in markets for higher potential returns but with possible losses. Both provide identical tax benefits, exempt from income tax and CGT, but cash suits conservative savers, per MoneySavingExpert. The choice impacts growth; stocks may outperform over 18 years despite volatility.

Are Junior ISAs better than Child Trust Funds?

Junior ISAs generally outperform CTFs due to higher provider competition and better rates, both offering tax-free growth but with Junior ISAs allowing up to £9,000 annually versus CTF’s £9,000 lifetime max. Many transfer maturing CTFs to Junior ISAs for continued benefits, as GOV.UK data shows with 415,000 transfers in 2024-25. For families without CTFs, starting a Junior ISA is the superior option for maximising junior ISA tax benefits.

How much tax can a Junior ISA save my child?

A Junior ISA can save substantial taxes; for instance, £162,000 in contributions at 4% interest over 18 years grows to £240,000 tax-free, versus £30,000+ in taxes on a standard account at 20% rate. What are the tax benefits of a junior isa include no income tax on interest exceeding £100 or CGT on gains, potentially saving £10,000-£50,000 depending on returns. These savings compound, making it a powerful tool for parents planning ahead.

Can parents claim tax relief on Junior ISA contributions?

Parents cannot claim tax relief or Gift Aid on Junior ISA contributions, as they are treated as post-tax gifts to the child. However, this avoids parental income tax on the child’s interest, unlike regular savings. For clarity on what are the tax benefits of a junior isa, focus on the child’s exemptions rather than donor perks, ensuring efficient family wealth transfer without HMRC deductions.