Understanding Junior ISAs

A Junior ISA, or Junior Individual Savings Account, is a tax-efficient way for UK parents or guardians to save for their child’s future. It allows contributions until the child turns 18, when they gain control of the funds. Unlike adult ISAs, only one parent or guardian can open it, but anyone can contribute.

Eligibility and setup

To open a Junior ISA, your child must be under 18 and a UK resident. You can set it up online or through a provider like those listed on MoneySavingExpert’s guide. No minimum age applies, making it ideal from birth. For more on the basics, see our article on what is a junior isa.

Types: cash vs stocks and shares

Junior ISAs come in two main types: cash versions offering steady interest like a savings account, and stocks and shares for potential higher growth through investments. Cash ISAs suit low-risk preferences, while stocks and shares align with long-term goals. The choice depends on your risk tolerance when comparing junior isa vs junior pension options.

Annual limits and tax perks

The annual allowance stands at £9,000 for the 2025/26 tax year, covering both types but not transferable between them. All growth is tax-free, shielding interest, dividends, and capital gains from HMRC. This makes Junior ISAs popular for child pension vs junior isa decisions.

What Is a Junior Pension (SIPP)?

A Junior Pension, often a Junior Self-Invested Personal Pension (SIPP), lets parents invest in their child’s retirement from an early age. It functions like an adult pension but for under-18s, with funds locked until retirement age. This setup contrasts sharply with the flexibility in junior isa vs pension comparisons.

How it works for children

Parents or guardians open the account, and contributions build a pot for the child’s future. Unlike Junior ISAs, it’s specifically for retirement, with tax relief enhancing value. Growing uptake is evident, with £79.6 million paid into Junior SIPPs in the last tax year, per Which? Money.

Contribution rules and tax relief

You can contribute up to £2,880 net annually, which HMRC boosts by 20% basic rate tax relief to £3,600 gross. Higher-rate taxpayers claim extra via self-assessment. This tax advantage is a key factor in child pension sipp vs junior investment isa debates, as detailed by Pinnacle Wealth.

Investment options

Junior SIPPs offer diverse choices like funds, shares, and bonds, similar to adult versions. This allows tailored growth strategies, though with market risks. For guidance on junior self invested personal pension vs isa, providers like Interactive Investor offer insights.

Key Differences: Junior ISA vs Junior Pension

When weighing junior isa vs junior pension, access, taxes, and risks define the choice. Junior ISAs provide earlier flexibility for needs like education, while pensions prioritise retirement boosts via tax relief.

Access and flexibility

Junior ISA funds become accessible at 18, ideal for university or home deposits. In contrast, Junior Pensions lock until age 55 (rising to 57 from 2028), per Interactive Investor. This long-term tie suits retirement but not short-term goals.

Tax treatment comparison

Both offer tax-free growth, but pensions add upfront relief on contributions. Junior ISAs have no such boost but higher limits. Higher-rate taxpayers benefit more from pensions in pension vs junior investment isa scenarios.

Risk and return profiles

Stocks and shares versions of both carry investment risks, but pensions’ longer horizon allows recovery from dips. Cash Junior ISAs are safer but lower-yielding. Projections show £9,000 annual Junior ISA investments from birth could reach £1.8 million by age 57 at 5% growth, according to The Private Office.

| Feature | Junior ISA | Junior Pension (SIPP) |

|---|---|---|

| Annual Limit (2025) | £9,000 | £2,880 net (£3,600 gross with relief) |

| Tax Benefits | Tax-free growth | 20% relief + tax-free growth |

| Access Age | 18 | 55 (57 from 2028) |

| Risk Level | Low (cash) to high (stocks) | Medium to high (investments) |

| Best For | Flexible future needs | Retirement planning |

Pros and Cons of Each Option

Junior ISAs excel in flexibility, while pensions shine in tax efficiency. Consider your goals when evaluating junior stocks and shares isa vs pension.

For short-term goals

Junior ISAs win here with 18-year access for education or travel. Pensions’ lock-in deters this use. List pros of Junior ISA: immediate control at maturity, higher contributions, no withdrawal penalties.

For retirement planning

Child pension vs junior isa tilts toward pensions for tax relief and compound growth over decades. Cons include illiquidity. Pros of Junior Pension: boosted contributions, inheritance tax perks.

Combined strategy

Many opt for both, maximising allowances. This hybrid covers near- and long-term needs without conflict.

How to Choose Based on Your Family’s Needs

Assess timelines and risk appetite in junior investment isa vs pension choices. For families eyeing university, prioritise ISAs; for legacy building, lean pensions.

Scenario examples

If your child plans abroad at 18, a Junior ISA funds it tax-free. For retirement security, a Junior SIPP grows substantially. Check Wealthify’s blog for more comparisons.

Costs and providers

Fees vary; low-cost platforms like Vanguard suit both. Compare via Moneyfacts. For the best junior isa options, explore our pillar guide.

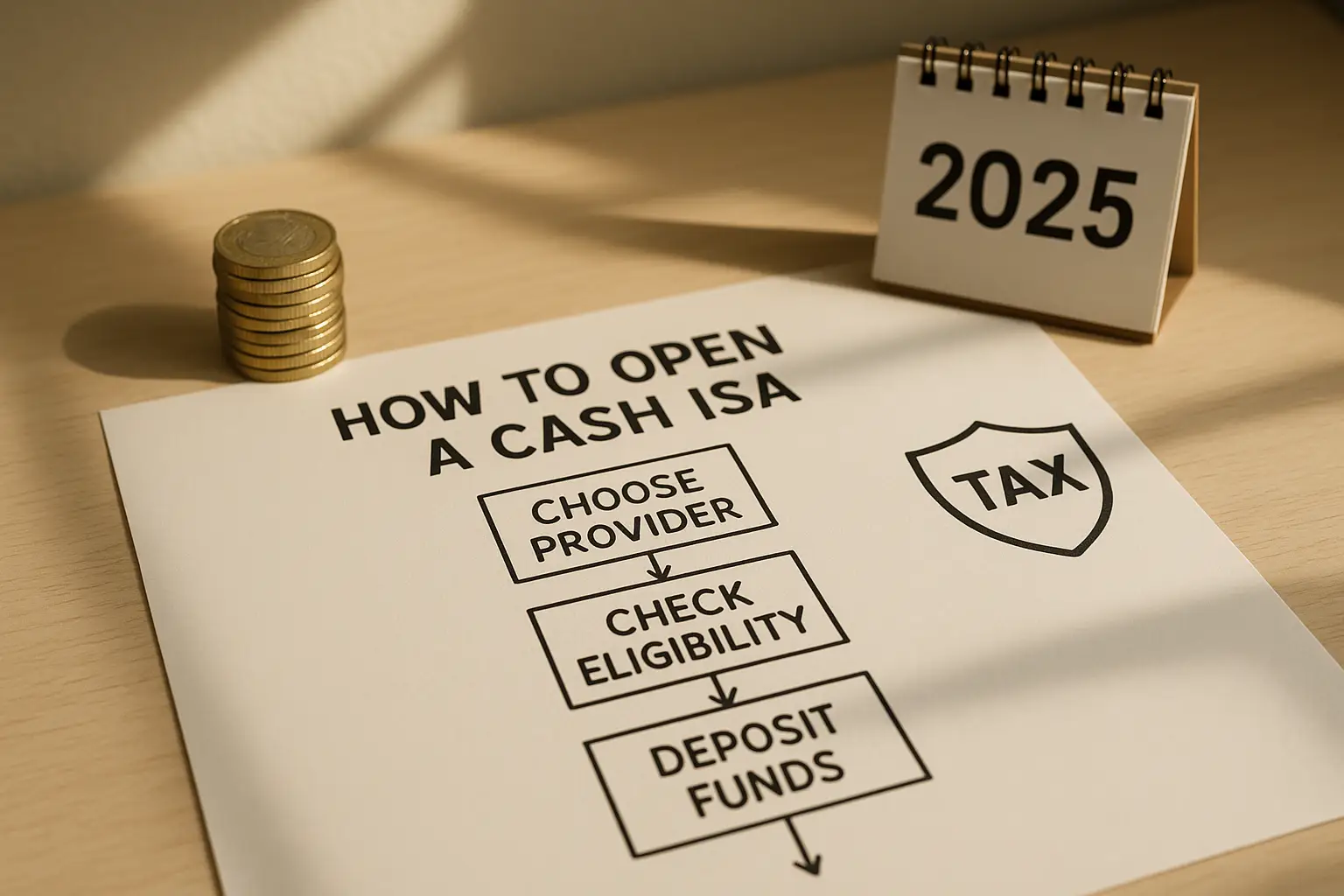

Next steps

Gather documents, choose a provider, and contribute regularly. Official rules are on GOV.UK. Remember, this is general information—not personalised advice. Consult a financial advisor.

Frequently Asked Questions

What is the difference between a Junior ISA and a Junior Pension?

The main differences lie in access and tax treatment when comparing junior isa vs pension. A Junior ISA allows withdrawal at 18 with tax-free growth on up to £9,000 annually, suiting flexible needs like education. A Junior Pension, or SIPP, offers 20% tax relief on contributions up to £3,600 gross but locks funds until 55 or 57, focusing on retirement. Parents often choose based on whether short-term access or long-term boosts matter more, as per HMRC guidelines.

Which is better for long-term savings: Junior ISA or child’s pension?

For pure long-term growth, a child’s pension edges out due to tax relief amplifying contributions in child pension vs junior isa scenarios. However, Junior ISAs allow higher annual inputs and earlier access, potentially better if funds are needed before retirement. Consider risk: both can invest in stocks, but pensions’ horizon suits compounding. Ultimately, it depends on your timeline—use projections like 5% growth to model outcomes.

Can I contribute to both a Junior ISA and a Junior Pension?

Yes, you can contribute to both without overlap, maximising savings in a junior self invested personal pension vs isa strategy. There’s no rule against it, allowing £9,000 to ISA and £2,880 net to pension yearly. This dual approach covers immediate and distant goals, but monitor family finances to avoid overcommitment. Track via provider apps for efficiency.

What are the tax benefits of a Junior SIPP vs Junior ISA?

Junior SIPPs provide upfront 20% tax relief, turning £2,880 into £3,600, plus tax-free growth—superior for basic-rate taxpayers in pension vs junior stocks and shares isa comparisons. Junior ISAs offer only tax-free growth on larger £9,000 contributions, no relief. Higher-rate users claim extra on SIPPs. Both shield from income tax and CGT, but SIPPs excel for retirement-focused families.

When can my child access money from a Junior ISA or Pension?

For Junior ISAs, access is at 18, with the child controlling funds thereafter for any purpose. Junior Pensions delay until 55 (57 from 2028), with 25% tax-free lump sum and rest taxed as income. Early access incurs penalties. This junior isa vs child pension adviser guide aspect influences choices for university vs retirement priorities.

How much can I contribute to a child’s pension in the UK?

The limit is £2,880 net per year for a child’s pension, boosted to £3,600 with basic tax relief, as per 2024 HMRC rules. This applies to Junior SIPPs and can’t exceed the adult annual allowance if linked. Contributions from anyone, but track for tax claims. For updates, refer to official sources amid changing policies.