Understanding Cash ISAs in 2025

A Cash ISA, or Individual Savings Account, is a tax-free savings vehicle in the UK that allows you to earn interest without paying income tax on it. For cash isa rates 2025, providers are offering competitive yields to attract savers amid fluctuating base rates. This guide compares the highest interest rates available, helping you make informed decisions on where to park your money this tax year.

What is a Cash ISA?

A Cash ISA functions like a regular savings account but with tax advantages. It holds cash and pays interest via AER (Annual Equivalent Rate), which shows the true return accounting for compounding. Unlike stocks and shares ISAs, Cash ISAs suit risk-averse savers seeking stability; for more on fundamentals, see our guide on what is a cash isa.

2025/26 Allowance and Eligibility

The annual Cash ISA allowance stands at £20,000 for the 2025/26 tax year, running from 6 April 2025 to 5 April 2026, as confirmed by HMRC via Cash ISA Rules. You must be 18 or over and a UK resident to qualify, with the option to split your allowance across multiple ISA types. Exceeding this limit incurs a 20% tax charge on the excess.

Tax Benefits vs Regular Savings

Cash ISAs shield interest from tax, unlike standard savings where earnings over the £1,000 personal savings allowance (for basic-rate taxpayers) are taxable. In 2025, with top cash isa rates 2025 reaching 4.51% AER, the tax-free perk can add hundreds to your returns. For higher earners, this benefit is even more pronounced, making ISAs preferable for sizeable deposits.

Best Easy Access Cash ISA Rates October 2025

The highest easy access Cash ISA rate in October 2025 is 4.51% AER from Trading 212, offering flexibility for savers needing quick withdrawals. These accounts suit those prioritising liquidity over locked-in yields. Compare options below to find the best easy access cash isa rates uk 2025.

Top Providers and AERs

Easy access ISAs allow penalty-free withdrawals anytime, ideal for emergency funds. Key picks include Trading 212 at 4.51% AER (minimum £1) and others like Plum at 4.20% AER. Always check FSCS protection, which covers up to £85,000 per provider.

| Provider | AER (%) | Minimum Deposit | Access Terms |

|---|---|---|---|

| Trading 212 | 4.51 | £1 | Unlimited withdrawals |

| Plum | 4.20 | £0.01 | Instant access |

| Chip | 4.00 | £1 | Flexible |

Data sourced from MoneySavingExpert’s best cash ISAs guide, accessed 16 October 2025. Rates can change daily.

Pros and Cons of Easy Access

- Pros: Immediate access to funds without penalties; variable rates that can rise with market improvements.

- Cons: Lower yields than fixed options (average 3.5% in 2025); rates may drop if the Bank of England cuts base rates.

Monthly Rate Fluctuations

Best cash isa rates uk july 2025 averaged 4.30% for easy access, dipping to 4.10% in August before rebounding to 4.51% in October due to steady inflation data. September saw a slight 0.05% rise post-Bank Rate hold. Track trends on sites like Moneyfactscompare for best cash isa rates uk august 2025 updates.

Tip: For best cash isa rates 2025, review your account monthly—switching easy access ISAs is straightforward and can boost returns by 0.5% or more annually.

Top Fixed Rate Cash ISA Deals for 2025

Fixed rate Cash ISAs lock in your money for a set period in exchange for higher guaranteed yields; the top one-year deal is 4.27% AER from Tembo via Investec. These suit savers confident in not needing funds soon. Explore best fixed cash isa rates 2025 for commitment-focused options.

1-Year Fixed Options

Average 1-year fixed rate is 3.89% AER as of October 2025. Top pick: Tembo/Investec at 4.27% (min £5,000, no early access). Shorter terms offer slightly lower rates around 4.10%.

Longer-Term Fixed Rates

For two-year bonds, expect 3.95% AER; over 550 days averages 3.84%. Providers like Shawbrook Bank lead with 4.00% for 18 months. Longer locks (e.g., five years) yield up to 3.70%, per Moneyfactscompare fixed rate ISAs.

Early Access Penalties

Withdrawing early typically costs 90-180 days’ interest, eroding gains. For example, on a £10,000 deposit at 4.27%, a penalty could exceed £100. Weigh this against inflation risks before committing.

Cash ISA Rates by Major Providers

Major banks offer competitive halifax cash isa rates 2025 and nationwide cash isa rates 2025, often with app-based ease. Virgin cash isa rates 2025 and santander cash isa rates 2025 appeal for online perks. Compare below for barclays cash isa rates 2025 and lloyds cash isa rates 2025.

Halifax and Nationwide

Halifax’s top easy access is 3.90% AER (min £1), while fixed one-year hits 4.10%. Nationwide leads with 4.00% easy access and 4.20% one-year fixed, both FSCS-protected. High-street convenience suits branch users.

Virgin Money and Santander

Virgin Money’s Double Take ISA blends easy access at 3.85% AER with bonus boosts. Santander’s one-year fixed is 4.00% (min £500). Both emphasise digital banking for quick setups.

Other Banks like Barclays and Lloyds

Barclays offers 3.75% easy access; Lloyds’ one-year fixed is 3.95%. For deeper dives, check Which? guide to best Cash ISAs.

Specialist Cash ISAs: Junior and Lifetime

Beyond standard options, junior and lifetime ISAs target families and first-time buyers. Best junior cash isa rates uk 2025 include 3.50% AER from Coventry Building Society. For adults, best cash lifetime isa interest rates uk 2025 reach 4.00% from Moneybox.

Best Junior ISA Rates

Junior ISAs grow tax-free until age 18, with £9,000 allowance. Top easy access: 3.60% AER (min £1). Fixed options yield 3.80% for one year, ideal for child savings plans.

Lifetime ISA for First-Time Buyers

Lifetime ISAs offer 25% government bonus on up to £4,000 yearly, plus cash rates up to 4.10% AER. Eligibility: under 40, for home purchase or retirement. Withdrawals for other purposes incur 25% charge.

Comparison to Standard ISAs

Standard Cash ISAs have higher allowances but no bonuses; specialists limit access but add incentives. For overall best cash isa rates uk 2025, standard easy access tops at 4.51%, outpacing junior yields.

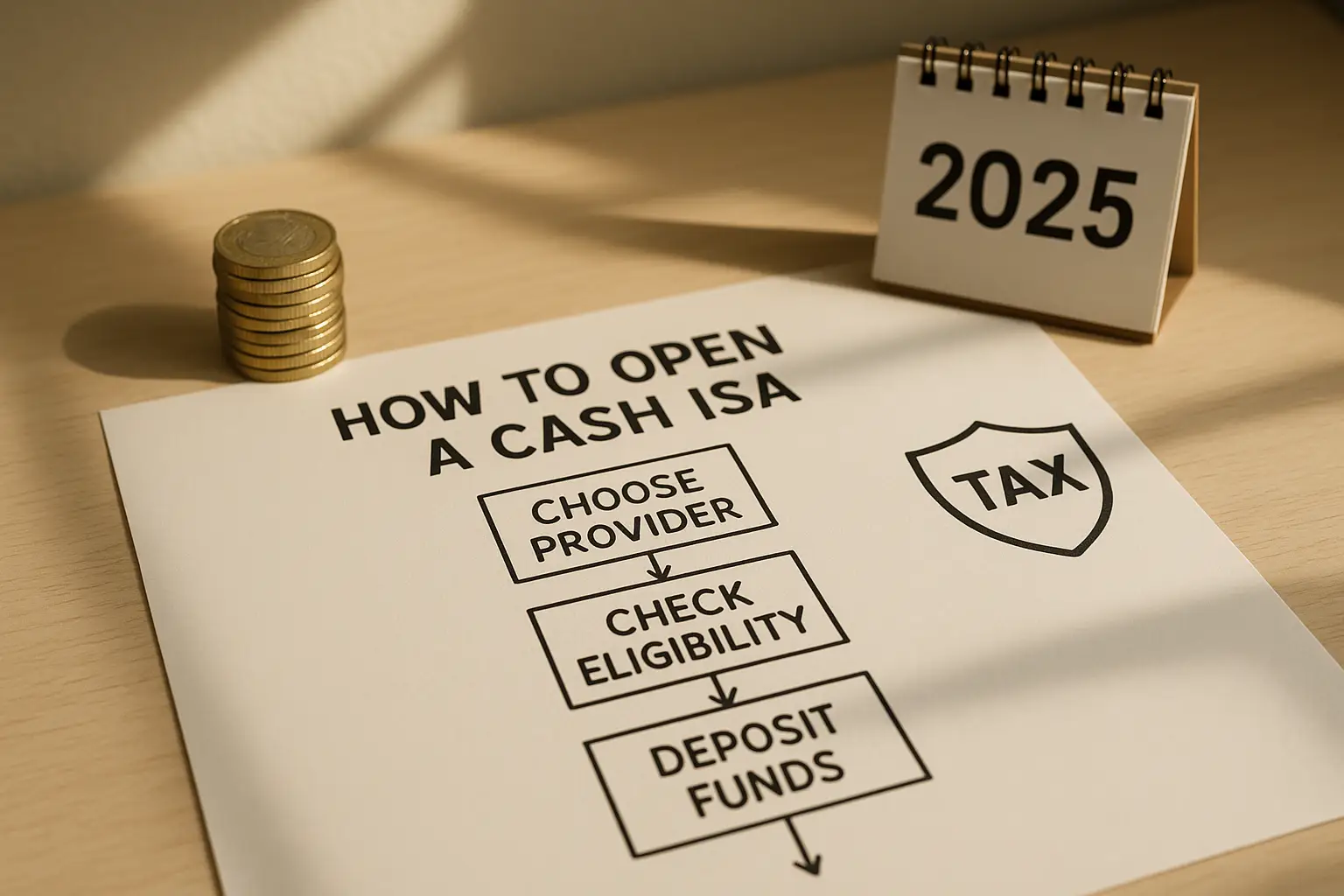

How to Choose and Switch Cash ISAs in 2025

Select based on access needs, rate stability, and fees; easy access for flexibility, fixed for guarantees. Use comparison tools for highest cash isa rates 2025. To switch, request a transfer—providers handle it free within 30 days.

Factors to Consider

- Rate vs liquidity: Prioritise AER for returns.

- Protection: Ensure FSCS coverage up to £85,000.

- Min deposit: Ranges from £1 to £10,000.

Switching Process

Contact your new provider to initiate; they transfer funds without closing your old ISA. No tax implications, but act before 5 April to use full allowance. For more, visit our pillar on best cash isa options.

Rate Forecasts for Rest of 2025

With Bank of England rates steady, easy access may hold at 4.20-4.50%; fixed could ease to 4.00% by year-end. Monitor for best cash isa rates uk september 2025 shifts. Forecasts from money.co.uk suggest modest declines if inflation cools.

Frequently Asked Questions

What is the best cash ISA rate in 2025?

The highest cash ISA rate in 2025 is 4.51% AER for easy access from Trading 212, as per MoneySavingExpert updates. This beats average yields of 3.89% for fixed one-year bonds, offering tax-free growth on up to £20,000. For risk-averse savers, it provides liquidity without sacrificing top returns, though rates fluctuate monthly.

How much can I put in a cash ISA in 2025?

You can save up to £20,000 in a Cash ISA during the 2025/26 tax year, per HMRC rules. This allowance covers all ISA types combined, allowing splits between cash, stocks, and lifetime variants. Exceeding it means paying tax on overflow interest, so plan deposits carefully to maximise tax-free benefits.

Are cash ISAs still worth it in 2025?

Yes, Cash ISAs remain valuable in 2025 due to rates outpacing inflation (around 2%) and tax shields for earnings over £1,000. With top yields at 4.51% AER, they outperform taxable accounts for basic-rate taxpayers. However, if rates fall below inflation, consider alternatives like premium bonds for lottery-like returns.

What are the current cash ISA rates?

Current cash isa rates 2025 as of October include 4.51% AER easy access and 4.27% for one-year fixed, varying by provider like Halifax at 3.90%. Averages hover at 3.84% for longer terms. These are tax-free and FSCS-protected; check daily via comparison sites to lock in the highest cash isa rates 2025.

Which bank has the highest cash ISA rate?

Trading 212 leads non-bank providers, but among banks, Nationwide offers 4.20% for one-year fixed, edging out Santander’s 4.00%. For easy access, Virgin Money hits 3.85%. Selection depends on your needs—high-street banks like Barclays suit in-person service, while online options maximise yields. Always verify FSCS coverage.

Can I transfer my old Cash ISA in 2025?

Yes, you can transfer previous Cash ISAs to new ones in 2025 without affecting your £20,000 allowance, as long as it’s not a new contribution. Providers facilitate free transfers within 30 days, preserving tax-free status. This strategy helps chase better rates, like from 3% to 4.51% AER, but avoid partial withdrawals to prevent tax charges.