What is a cash ISA and why choose one in 2025?

A cash ISA (Individual Savings Account) is a tax-free savings account that lets UK residents save up to £20,000 per tax year without paying income tax on the interest earned. In 2025, with inflation stabilising and base rates potentially holding steady, cash ISAs remain a secure way to grow savings tax-free, especially for basic-rate taxpayers who might otherwise face a 20% tax hit on interest from regular accounts. Choosing the best cash ISA now can maximise returns, as top rates hover around 4.51% AER for easy access options, beating many standard savings accounts after tax.

Key benefits and tax rules

The core benefit of a cash ISA is its tax-free status, shielding interest from the Personal Savings Allowance (up to £1,000 tax-free for basic-rate taxpayers outside ISAs). Unlike regular savings, all growth in a cash ISA is yours to keep, making it ideal for conservative savers seeking the best cash ISA rates UK-wide. Rules from HM Revenue & Customs require you to be 18+ and a UK resident, with interest calculated daily but paid annually or on maturity.

Current allowance and eligibility

For the 2025/26 tax year, the ISA allowance stands at £20,000, unchanged from previous years and safe from the proposed cut to £5,000, which is on hold until at least 2026. You can split this across cash, stocks and shares, or other ISA types, but total subscriptions cannot exceed the limit. Eligibility is straightforward for most UK residents, though non-doms or expatriates may face restrictions—check the official HMRC ISA rules for details.

Comparison to regular savings

Regular savings accounts often offer competitive rates but expose interest to tax, potentially reducing net returns by up to 45% for higher-rate taxpayers. For example, a 4% rate on £10,000 in a non-ISA yields £400 gross but only £320 after 20% tax, versus £400 tax-free in the best cash ISA. High street banks like NatWest provide solid alternatives, but for tax efficiency, cash ISAs win, especially with FSCS protection up to £85,000 per provider—details on FSCS coverage.

Best easy access cash ISAs

Top easy access cash ISAs in 2025 offer flexibility with rates up to 4.51% AER, perfect for those needing quick withdrawals without penalties. Providers like Trading 212 lead with competitive bonuses, while big names such as Bank of Ireland UK deliver reliable 4.16% AER. These accounts suit emergency funds or short-term parking of cash, with unlimited access and minimum deposits as low as £1.

Top rates and providers

As of October 2025, Trading 212 tops the best easy access cash ISA rates at 4.51% AER, including a 0.66% bonus for 12 months. Moneybox follows closely with 4.38% AER (0.68% bonus), app-based for easy management. For traditional banking, Bank of Ireland UK offers 4.16% AER—check current figures via Moneyfacts ISA comparisons.

| Provider | AER (%) | Min Deposit | Access Rules |

|---|---|---|---|

| Trading 212 | 4.51 | £1 | Unlimited withdrawals |

| Moneybox | 4.38 | £1 | Flexible, app-managed |

| Bank of Ireland UK | 4.16 | £1 | Instant access |

Pros and cons

Pros include instant access to funds and competitive variable rates that can rise with market changes, making them the best instant access cash ISA for liquidity. Cons are potential rate drops if the Bank of England cuts base rates, and bonuses that expire, reducing yields after 12 months. Overall, they outperform regular savings for tax-free growth.

Who they’re for

These suit savers who prioritise flexibility, such as those building an emergency pot or with unpredictable expenses. If you’re searching for the best cash ISA rates today, easy access options from providers like Virgin Money are ideal for beginners.

Best fixed rate cash ISAs by term

Fixed rate cash ISAs lock in rates for a set period, with the best fixed rate cash ISA offering up to 4.27% AER for one year, shielding savers from rate falls. Ideal for those with savings they won’t need soon, these provide certainty on the best cash ISA interest rates. Terms range from 1 to 5 years, with longer locks often yielding higher returns.

1-year fixed options

The standout best 1 year fixed rate cash ISA is 4.27% AER from Tembo via Investec, with no early withdrawals allowed. This beats variable rates for short-term commitment, minimising risk in a potentially volatile 2025. Minimum deposits vary, often £5,000+.

2-year and longer terms

For two years, expect around 4.0% AER from providers like Nationwide, while the best 5 year fixed rate cash ISA might reach 3.8% AER for long-term security. These are best for lump sums you can commit, like inheritance or bonuses. Compare via Nationwide’s fixed rate options.

Rate forecasts for late 2025

Experts predict fixed rates holding at 4%+ if base rates stabilise, but drops could follow economic easing—current best fixed cash ISA rates reflect this caution. Martin Lewis recommends locking in now for the best 2 year cash isa deals before changes.

| Type | Rate (AER %) | Tax-Free Interest | After 20% Tax (Non-ISA) |

|---|---|---|---|

| Easy Access | 4.51 | £451 | £361 |

| 1-Year Fixed | 4.27 | £427 | £342 |

Specialist cash ISAs: Juniors, flexible, and seniors

Specialist cash ISAs cater to specific needs, with the best junior cash ISA rates around 4.0% AER for children’s savings, flexible options allowing withdrawals and replacements without affecting allowance, and senior deals like the best cash ISA rates for over 60s at up to 4.2% AER. These fill gaps in standard accounts, offering tailored tax-free growth.

Best junior rates

Junior ISAs allow £9,000 annual contributions for under-18s, maturing tax-free at 18—the best junior cash ISA from providers like Yorkshire Building Society offers competitive easy access. Parents can start small, building future funds securely. See Yorkshire Building Society cash ISAs for eligibility.

Flexible withdrawal rules

The best flexible cash ISA, like Moneybox’s, lets you withdraw and replace funds within the same tax year without using extra allowance—key for irregular savers. Rates match easy access at 4.38% AER, combining liquidity with tax perks.

Options for over-60s

Seniors benefit from boosted rates; the best fixed cash ISA rates for over 60s hit 4.2% AER from Virgin Money. These often include easier access or higher limits, ideal for retirement pots. Check Money.co.uk’s cash ISA reviews for age-specific picks.

How to choose and open the best cash ISA

To pick the best cash ISA UK-wide, prioritise AER, access needs, and FSCS protection, balancing flexibility against locked rates for maximum returns. Compare providers using tools from MoneySavingExpert, which Martin Lewis endorses for MSE best cash ISA insights. Avoid low minimum deposits if they mean lower rates.

Factors to consider (rates, access, FSCS)

Focus on AER (Annual Equivalent Rate, showing true yearly return) and withdrawal penalties—easy access for liquidity, fixed for guarantees. Ensure FSCS covers up to £85,000. The best cash ISA accounts also factor in bonuses and term lengths.

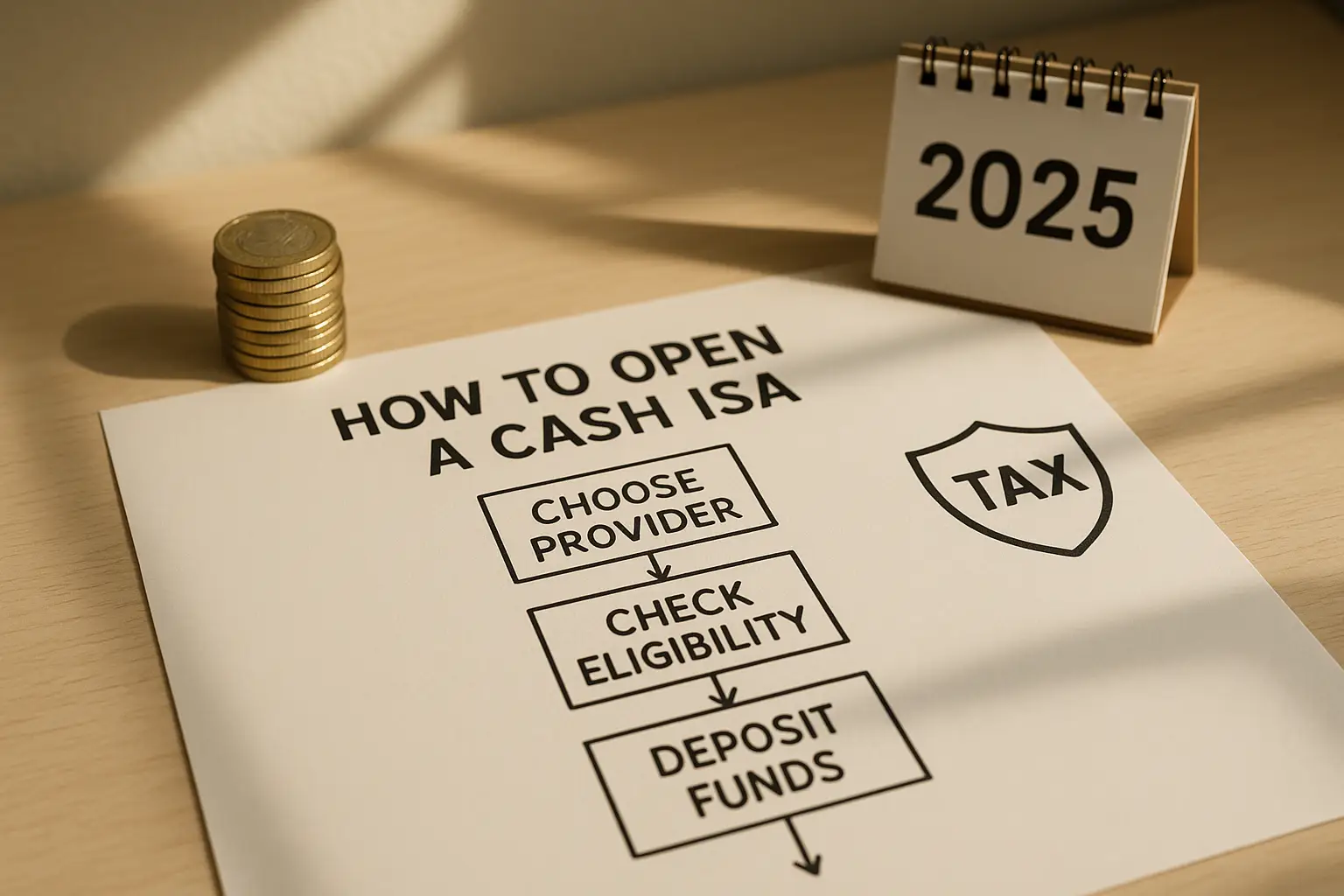

Step-by-step guide

1. Assess your savings goal and risk tolerance.

2. Compare rates on aggregator sites like Moneyfacts.

3. Check eligibility and apply online or in-branch—most take 10 minutes.

4. Transfer existing ISAs if needed, via the provider.

5. Monitor annually for switches.

Common mistakes to avoid

Don’t exceed the £20,000 allowance across all ISAs, or you’ll face tax penalties. Ignore variable rate drops by not reviewing yearly, and overlook fees on some best cash ISA deals. Always verify current best cash ISA rates UK 2025 before committing.

Top providers and deals

Leading providers like Nationwide, Virgin Money, and Trading 212 dominate 2025’s best cash ISA UK landscape with strong rates and apps. Nationwide’s best cash ISA rates nationwide appeal to loyal customers, while Trading 212 innovates with high-yield easy access. Deals include bonuses, but read terms carefully.

Nationwide, Virgin Money, Trading 212 reviews

Nationwide offers reliable fixed rates up to 4.0% AER, FSCS-protected. Virgin Money’s easy access hits 4.1%, user-friendly online. Trading 212’s 4.51% suits digital savers—review NatWest ISA overview for alternatives.

Current promotions

Look for bonuses like Moneybox’s 0.68% add-on in best cash ISA deals UK. These boost initial AER but check expiry.

Rate change alerts

Sign up for alerts from Moneyfacts’ weekly roundup at Moneyfacts ISA rates this week to catch the best cash ISA savings rates shifts.

In summary, the best cash ISA in 2025 delivers tax-free returns up to 4.51% AER—start by comparing easy access or fixed options today to secure your savings.

Frequently asked questions

What is the best cash ISA rate right now?

As of October 2025, the top easy access cash ISA rate is 4.51% AER from Trading 212, including a bonus, ideal for flexible savers seeking the best cash ISA rates. Fixed options lag slightly at 4.27% AER for one year from Tembo via Investec, but offer stability. Rates change frequently, so verify via trusted comparators like MoneySavingExpert for the latest best cash ISA rate.

How much can I put in a cash ISA?

UK residents aged 18+ can contribute up to £20,000 to all ISAs combined in the 2025/26 tax year, running from 6 April 2025 to 5 April 2026. This allowance resets annually and includes cash, stocks, and other types—exceeding it triggers tax on excess interest. For juniors, the limit is £9,000; plan contributions to maximise tax-free growth without penalties.

Are cash ISAs worth it in 2025?

Yes, with rates above inflation and the allowance intact at £20,000, cash ISAs shield savings from tax, potentially adding hundreds to returns versus taxable accounts. Even as the Personal Savings Allowance covers £1,000 interest tax-free for basic-rate taxpayers, ISAs benefit higher earners or those saving more. In a stable rate environment, they’re a low-risk way to beat erosion—Martin Lewis highlights their value in current best cash ISA guides.

What’s the difference between easy access and fixed rate ISAs?

Easy access cash ISAs allow withdrawals anytime without penalty, with variable rates like 4.51% AER suiting short-term needs, but they can fall with market changes. Fixed rate ISAs lock funds for 1-5 years at guaranteed rates, such as 4.27% for one year, protecting against drops but penalising early access. Choose based on liquidity—easy for emergencies, fixed for committed sums in the best fixed rate cash ISA.

Can I have more than one cash ISA?

You can hold multiple cash ISAs from different providers, but total contributions across all ISAs cannot exceed £20,000 yearly. This lets you diversify for better rates, like one easy access and one fixed, without tax issues. Transfers between providers preserve allowance, but opening multiples requires checking each’s terms to optimise the best cash ISA accounts.

What are the best cash ISA rates for over 60s?

Seniors often access preferential rates, with top options reaching 4.2% AER on fixed terms from providers like Virgin Money, tailored for retirement income. Easy access variants offer around 4.0% with fewer restrictions, beating standard savings post-tax. These accounts consider age eligibility and higher Personal Savings Allowances, making them worthwhile—compare via specialist guides for age-specific best cash ISA rates for over 60s.