Understanding Junior ISAs in 2025

A Junior ISA is a tax-efficient savings or investment account designed for children under 18, opened by a parent or guardian on their behalf. It allows tax-free growth until the child reaches 18, when they gain full control. For a detailed explanation, read our guide on what is a junior isa.

What is a Junior ISA?

The core benefit of a Junior ISA is its tax-free status, shielding interest, dividends, and capital gains from UK taxes. Parents can contribute annually, building a nest egg for education or future needs. Unlike regular savings accounts, withdrawals are restricted until age 18 to encourage long-term saving.

Cash vs Stocks and Shares Options

Cash Junior ISAs offer security with fixed interest rates, ideal for risk-averse families, while stocks and shares versions provide potential for higher returns through investments in funds or shares, though with market volatility. Cash options suit short-term goals, whereas stocks and shares are better for long-term growth. Comparing these in a best junior isa context helps parents match options to their risk tolerance.

Annual Allowance and Tax Benefits

For the 2025/26 tax year, the annual Junior ISA allowance stands at £9,000, covering both cash and stocks and shares combined, as confirmed by Moneyfactscompare. All growth within the account is tax-free, maximising returns without HMRC deductions. This benefit is particularly valuable given over 1.5 million Junior ISAs open in the UK as of 2024, with balances growing by 8% annually, per HM Revenue and Customs data—though 2025 figures may vary.

Top Junior ISA Providers Ranked

Based on fees, rates, and features, leading providers like AJ Bell and Hargreaves Lansdown stand out in this junior ISA providers comparison for 2025. We evaluated them for UK families seeking value.

Best for Cash ISAs

Providers such as Coventry Building Society and Nationwide offer competitive cash Junior ISAs with easy access. They excel in high AER rates and no withdrawal penalties until maturity. For the best junior cash ISA rate in 2025, focus on those topping 4%.

Best for Stocks and Shares

AJ Bell leads with its 0.25% platform fee and diverse fund options, earning high marks in Trust Intelligence reviews. Hargreaves Lansdown follows closely with no setup fees and a vast investment range. These shine for growth-oriented parents.

Overall Top Picks

- AJ Bell: Low fees, wide choices.

- Hargreaves Lansdown: User-friendly platform.

- Fidelity: Strong research tools.

These top the best junior ISA providers UK 2025 comparison for balanced performance.

Fees and Charges Breakdown

Fees can erode returns, so scrutinise platform charges and dealing costs in your junior ISA providers comparison UK.

Platform and Dealing Fees

AJ Bell charges a low 0.25% annual platform fee, while Hargreaves Lansdown levies 0.45%, capped at £3.75 monthly for funds, with no dealing fees for popular investments, as detailed on their site. Fidelity offers tiered fees starting at 0.35%. Always check for minimums to avoid surprises.

Exit and Transfer Costs

Most providers allow free transfers to consolidate accounts, but some impose exit fees up to £25. Yes, you can transfer a Junior ISA to another provider without losing tax benefits, per Money Saving Expert guidelines. Plan ahead to minimise costs.

Hidden Charges to Watch

Beware of currency conversion fees for international funds or inactivity charges on dormant accounts. Compare these in depth for the best junior ISA providers UK 2025 comparison.

Tip: Use a fee calculator from provider sites to project costs over 18 years. Factor in inflation to ensure your choice aligns with long-term goals.

Current Rates and Returns 2025

Top rates as of October 2025 reach 4.4% AER for cash Junior ISAs, variable and subject to change, according to Which?.

Top Interest Rates

Cash rates hover around 4-4.4% AER from providers like Shawbrook Bank. Stocks and shares returns vary, averaging 5-7% historically, but expect volatility.

Investment Performance Expectations

Over five years, stocks and shares Junior ISAs have outperformed cash by 3-5% annually, based on industry data. For 2025 projections, anticipate moderate growth amid economic recovery.

Rate Comparison Table

| Provider | Type | AER/Expected Return | Platform Fee | Min Deposit |

|---|---|---|---|---|

| AJ Bell | Stocks & Shares | 5-7% avg | 0.25% | £250 |

| Hargreaves Lansdown | Stocks & Shares | 5-7% avg | 0.45% | £100 |

| Coventry BS | Cash | 4.4% AER | None | £1 |

| Nationwide | Cash | 4.2% AER | None | £1 |

Key Features and Considerations

Beyond rates, evaluate apps and support for seamless management.

App and Accessibility

Top providers like Fidelity offer intuitive apps for tracking growth. Mobile access ensures parents can monitor contributions easily.

Customer Support

Look for 24/7 chat or phone support; AJ Bell scores high here in reviews.

Sustainability Options

Vanguard provides ethical funds, appealing to eco-conscious families in 2025.

How to Choose and Switch Providers

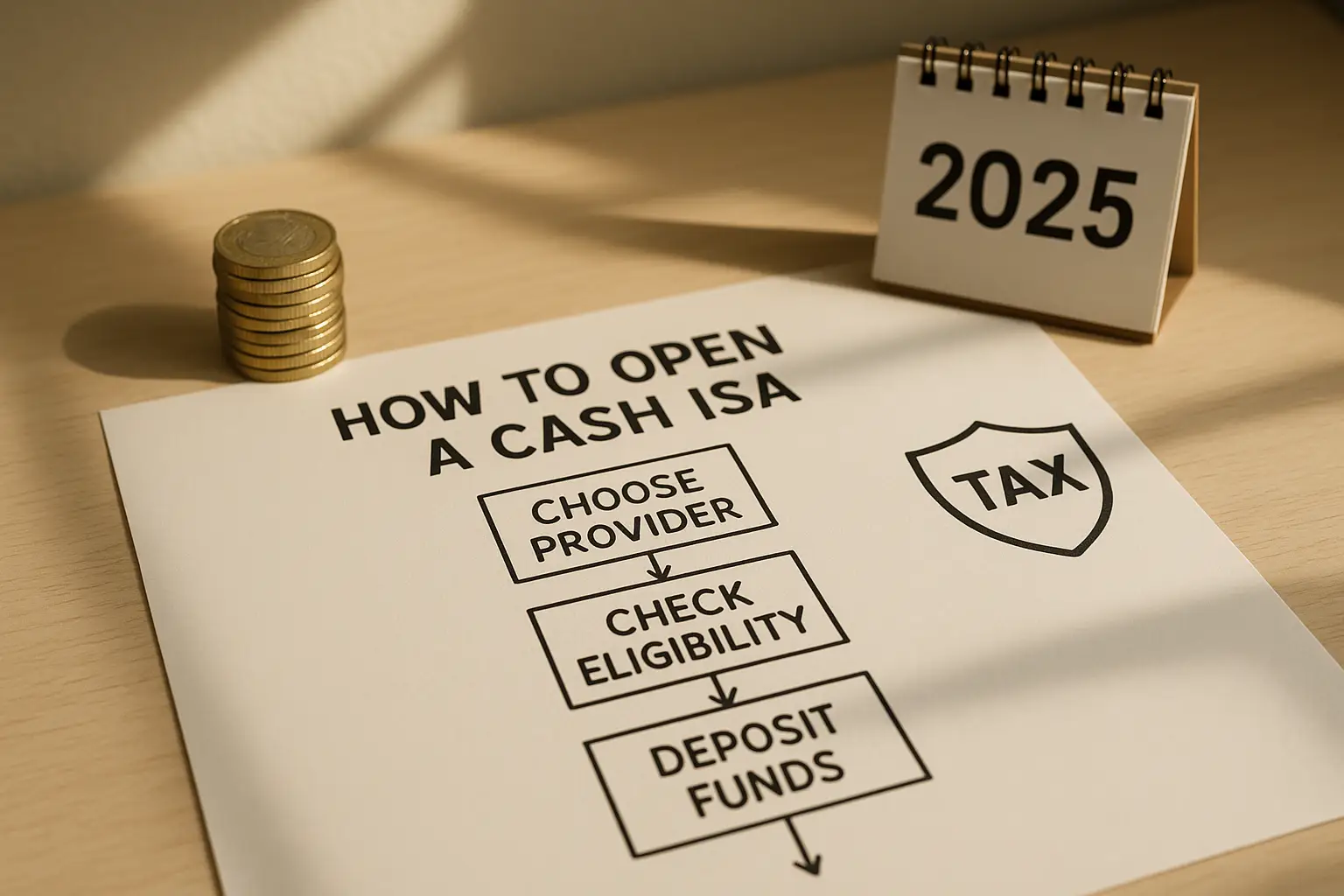

Prioritise low fees and growth potential in your decision. For steps on setup, see how to open a junior isa.

Factors for Parents

Assess risk appetite, investment variety, and ease of use. Compare via tools for personalised junior ISA providers comparison.

Transfer Process

Contact the new provider to initiate a free transfer; it takes 15-30 days. No tax implications apply. For tax details, explore junior isa tax benefits.

Long-Term Growth Tips

Contribute maximally annually and review investments yearly. Diversify to mitigate risks.

Frequently asked questions

What is the best junior cash ISA rate in 2025?

The top junior cash ISA rate in 2025 is 4.4% AER, offered by select providers like those highlighted by Which?, providing a safe haven for savings amid fluctuating economies. This rate applies to easy-access accounts, allowing flexibility for parents. However, rates can change, so verify current offers and consider inflation’s impact on real returns for long-term planning.

How do junior stocks and shares ISAs compare to cash ISAs?

Junior stocks and shares ISAs offer higher potential returns through market investments, historically outperforming cash by 3-5% annually, but they carry volatility risks unlike the guaranteed principal in cash ISAs. Cash versions provide stability with AER around 4%, suitable for conservative savers, while stocks suit those with 18-year horizons. In a junior ISA providers comparison, choose based on your child’s future needs and market outlook for 2025.

What are the fees for popular junior ISA providers?

Popular providers like AJ Bell charge 0.25% platform fees, Hargreaves Lansdown 0.45% capped monthly, and many cash options have none, as per Trust Intelligence and provider data. Dealing fees vary, often waived for funds, but watch for exit costs during transfers. For the best junior ISA providers UK 2025 comparison, calculate total costs over time to ensure value, especially with £9,000 allowances.

Can I transfer a junior ISA to another provider?

Yes, transferring a Junior ISA to another provider is straightforward and free in most cases, preserving tax benefits as outlined by Money Saving Expert. Initiate via the new provider, who handles paperwork, typically within a month. This is ideal for switching to better rates or features in 2025, but avoid mid-year to maximise contributions.

What happens to a Junior ISA when the child turns 18?

At 18, the child gains full control, converting it to an adult ISA with the same £20,000 allowance, per HMRC rules. They can withdraw or reinvest freely, but early access risks tax penalties if not managed properly. Parents should discuss options beforehand to guide responsible use, aligning with long-term financial education.

How do I choose the best junior ISA provider for 2025?

Select based on fees, rates, and features matching your risk profile in this junior ISA providers comparison UK, using tables and reviews from sources like Which?. Consider minimum deposits and app usability for ongoing management. Consult independent advice, as this is not personalised financial guidance, to optimise for your family’s goals.

This article is for informational purposes only and does not constitute financial advice. Always consult a qualified advisor before making decisions.