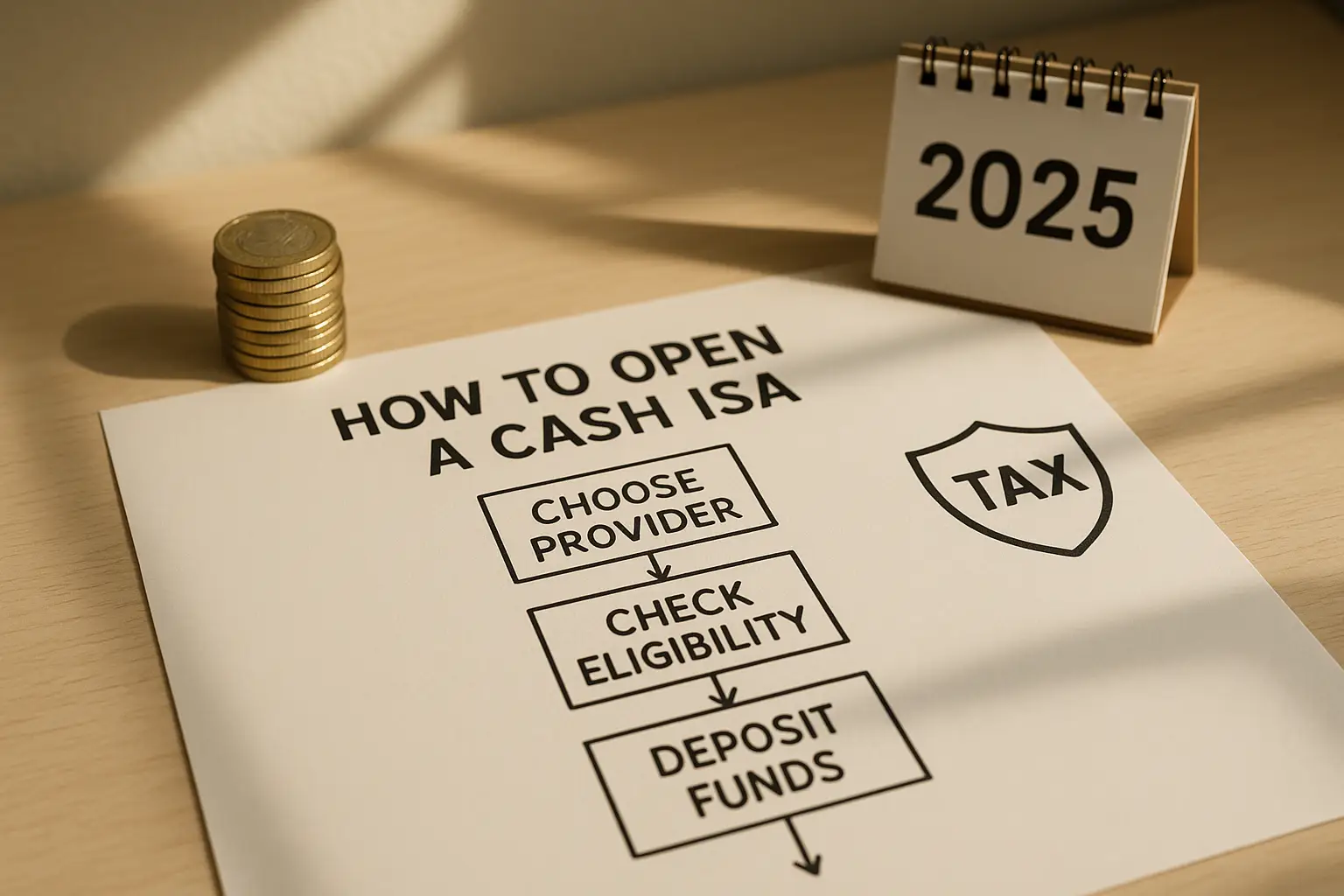

What is an easy access ISA and how does it work?

An easy access ISA is a flexible tax-free savings account that allows you to withdraw money without penalties, making it ideal for those seeking the best easy access ISA options in 2025. These accounts, specifically cash ISAs, earn interest on your deposits while keeping earnings tax-free up to the annual allowance. Unlike fixed-rate ISAs, easy access versions offer liquidity, so you can access funds anytime without losing interest accrued.

Key features and benefits

The core benefit of the best easy access cash ISA is its balance of growth and accessibility. Interest is typically calculated daily and paid annually or monthly, depending on the provider. With rates hovering around 4% AER in 2025, they outperform standard savings accounts, especially as the UK’s base rate stabilises post-inflation peaks.

- Tax-free interest: No income tax on earnings, a major advantage for higher-rate taxpayers.

- Full withdrawal flexibility: No notice periods or charges for accessing funds.

- Annual allowance: Up to £20,000 per tax year (6 April to 5 April), unchanged for 2025/26 per HMRC rules.

Differences from fixed-rate ISAs

Fixed-rate ISAs lock your money for a set period in exchange for potentially higher rates, but early withdrawals often incur penalties. Easy access ISAs, by contrast, suit emergency funds or short-term savings. For instance, while a one-year fixed ISA might offer 4.28% AER from Vida Savings, the best easy access ISA rates like Trading 212’s 4.53% AER allow immediate access without loss.

Tax advantages in the UK

ISAs shield savings from the personal savings allowance—£1,000 for basic-rate taxpayers and £500 for higher earners—making them essential amid rising interest rates. As Martin Lewis from MoneySavingExpert highlights, utilising your ISA allowance maximises tax-free growth, especially with average easy access rates at 1.99% versus inflation at 3.8%.

Current best easy access ISA rates in 2025

The top easy access ISA rates in 2025 reach 4.53% AER, far exceeding the UK average of 1.99% for cash ISAs, driven by competitive providers amid steady base rates. Providers like Trading 212 lead, but rates can fluctuate, so monitoring is key for the best easy access cash ISA rates.

Top AER rates overview

As of October 2025, the best rate easy access ISA stands at 4.53% AER from Trading 212, with Bank of Ireland UK close at 4.16% AER. These variable rates apply to balances up to £20,000, with minimum deposits as low as £1.

Comparison of leading providers

Here’s a table comparing the best easy access ISA accounts based on current data:

| Provider | Rate (AER) | Minimum Deposit | Interest Payout | Withdrawals |

|---|---|---|---|---|

| Trading 212 | 4.53% | £1 | Annually | Unlimited |

| Bank of Ireland UK | 4.16% | £1 | Annually | Unlimited |

| Tembo | 4.10% | £1 | Monthly | Unlimited |

| Vida Savings (limited access) | 4.28% | £10,000 | Annually | 3 per year |

This comparison draws from MoneySavingExpert’s latest scans, showing app-based options like Tembo excel for monthly interest seekers.

Impact of base rate changes

The Bank of England’s base rate, held at 5% in late 2025, supports strong easy access ISA interest rates, but anticipated cuts could lower yields. Experts like Martin Lewis recommend switching to the best easy access cash ISA rates now to lock in gains before any downturn.

Top easy access cash ISA accounts

For high returns and effortless savings, the top picks include Trading 212’s 4.53% AER account for its unlimited access and low entry, ideal for the best easy access ISA in the UK. Yorkshire Building Society offers a reliable 3.75% AER option with branch support, suiting traditional savers.

Trading 212 and app-based options

Trading 212’s cash ISA appeals to digital natives with seamless app transfers and competitive rates. It allows flexible contributions and full liquidity, aligning with searches for the best flexible easy access cash ISA.

Big bank picks like Bank of Ireland

Bank of Ireland UK’s 4.16% AER provides stability from an established lender, with easy online management. It’s a strong contender for the best easy access cash ISA UK, especially for those valuing FSCS protection up to £85,000.

Building society choices

Options like Leeds Building Society’s 4.10% AER emphasise community focus and transfer-friendly policies. For the best easy access ISA transfer, these societies often match incoming ISAs without fees, preserving your tax-free status.

Best easy access ISAs for over 60s

Seniors can access tailored easy access ISAs with rates up to 4.20% AER, often with perks like guaranteed minimums, addressing the best easy access cash ISA rates for over 60s. Providers consider age-related needs, such as joint accounts or higher personal savings allowances.

Senior-specific rates and perks

While not always exclusive, accounts from building societies like Yorkshire offer 4.00%+ for over-60s, with flexible withdrawals for pension supplements. These beat the 1.99% average, helping combat inflation.

Higher rate taxpayer considerations

For those over 60 in higher tax bands, ISAs fully utilise the £500 personal savings allowance. Combining with easy access ensures liquidity for healthcare costs without tax erosion.

Personal Savings Allowance integration

Over-60s benefit from integrating ISAs into broader savings strategies, as non-ISA interest counts against allowances. Opt for the best easy access ISA for over 60s to maximise tax efficiency.

Flexible and transfer-friendly easy access ISAs

Flexible easy access ISAs allow withdrawals and same-day redeposits within the allowance, perfect for irregular savers seeking the best easy access flexible ISA. Transfers to these accounts are penalty-free, enabling switches to higher rates like 4.53% without losing tax benefits.

For the best easy access ISA transfer, use providers allowing incoming transfers, such as Bank of Ireland. This keeps your entire pot tax-free, unlike closing and reopening.

Frequently asked questions

What is the best easy access ISA rate right now?

The best easy access ISA rate in late 2025 is 4.53% AER from Trading 212, offering unlimited withdrawals and a low £1 minimum deposit. This rate outperforms the UK average of 1.99%, providing substantial tax-free growth on up to £20,000 annually. However, rates are variable, so verify with providers like MoneySavingExpert for real-time updates to ensure you secure the best easy access cash ISA rate.

How do easy access ISAs work?

Easy access ISAs function as tax-sheltered savings accounts where you deposit up to £20,000 yearly, earning interest without tax liability. Withdrawals are penalty-free, and interest compounds daily in most cases, paid annually or monthly. They differ from stocks and shares ISAs by focusing on cash stability rather than investments, suiting risk-averse savers seeking the best easy access ISA UK options.

Can I transfer my ISA to an easy access account?

Yes, you can transfer your existing ISA to an easy access account without affecting its tax-free status, as long as the new provider is UK-authorised. This is ideal for chasing higher rates, like moving to Trading 212’s 4.53% AER. The process is free and straightforward, but inform your current provider to avoid accidental closure; it’s a key strategy for the best easy access ISA transfer.

What is the ISA allowance for 2025/26?

The ISA allowance for 2025/26 remains £20,000, allowing UK residents aged 18+ to save or invest tax-free across all ISA types, including cash variants. You can split this across multiple ISAs, but the total cannot exceed the limit. As per HMRC guidelines, unused allowance doesn’t carry over, so maximising it in easy access accounts ensures optimal growth amid 2025’s competitive rates.

Are there easy access ISAs for over 60s?

Many providers offer easy access ISAs suitable for over 60s, with rates up to 4.20% AER and features like monthly interest for pension income. While not always age-restricted, building societies often provide senior-friendly perks, such as no-notice withdrawals. These align with the best easy access ISA rates for over 60s, integrating well with personal savings allowances to enhance retirement security.

What’s the difference between cash ISA and stocks and shares ISA?

A cash ISA is a low-risk, interest-bearing account like the best easy access cash ISA, guaranteeing your principal with AER up to 4.53%. Stocks and shares ISAs invest in markets for potentially higher returns but with volatility and possible losses. Cash versions suit conservative savers needing liquidity, while shares appeal to long-term growth seekers; both share the £20,000 allowance.

How often is interest paid on easy access ISAs?

Interest on easy access ISAs is typically paid annually, but options like Tembo’s 4.10% AER provide monthly payouts for steady income. This frequency affects compounding, with monthly options accelerating growth. For the best easy access ISA with monthly interest, compare providers to match your cash flow needs, ensuring tax-free benefits throughout 2025.