What is an ISA and who can open one?

An Individual Savings Account (ISA) is a tax-free wrapper for your savings and investments in the UK, allowing you to earn interest or gains without paying income tax or capital gains tax. For 2025, the annual ISA allowance remains at £20,000, meaning you can save or invest up to this amount across all your ISAs without tax implications. To open an ISA, you must be a UK resident aged 18 or over for standard accounts; younger individuals can benefit from Junior ISAs opened by parents or guardians.

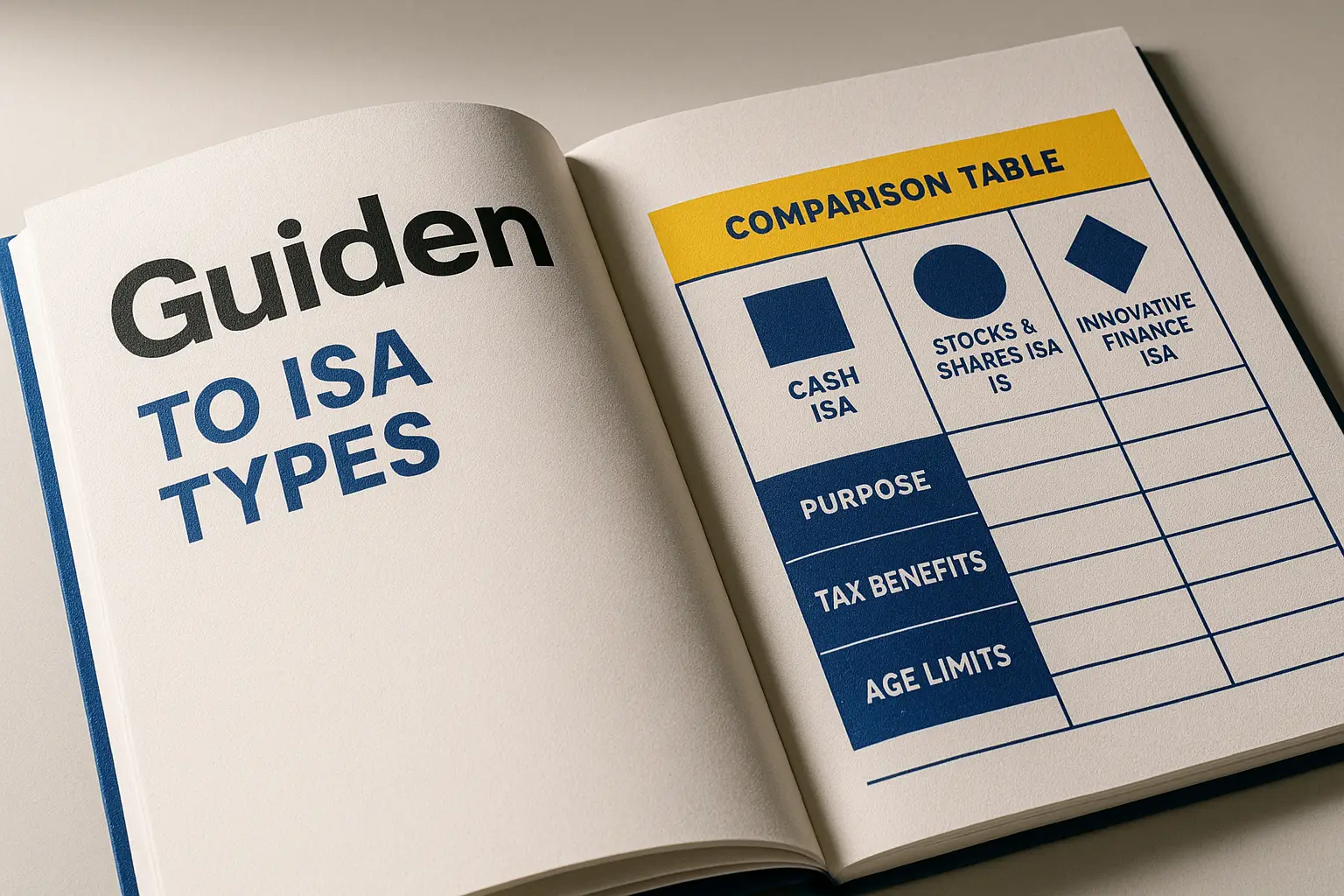

Types of ISAs available

ISAs come in various forms to suit different needs, such as Cash ISAs for low-risk savings similar to a bank account, and Stocks and Shares ISAs for potential higher returns through investments. Other options include Lifetime ISAs for first-time buyers or retirement savers, offering a 25% government bonus on contributions up to £4,000 annually. For more on types of isa accounts, explore the full range.

Age and residency requirements

You need to be at least 18 years old to open an ISA account yourself, as confirmed by HMRC rules, though Junior ISAs are for children under 18 with no minimum age. UK residency is required, and you must have a National Insurance number to declare your tax status. No changes to these eligibility criteria are expected for 2025, ensuring broad access for adults.

Choose the right type of ISA for your needs

Start by assessing your goals: if preserving capital is key, a Cash ISA offers guaranteed returns with FSCS protection up to £85,000 per provider. For growth-oriented savers, a Stocks and Shares ISA allows investing in funds or shares, though with market risks. Specialised types like the Lifetime ISA suit long-term plans, but early withdrawals incur penalties except for eligible uses.

To learn more about what is an isa, this overview covers the fundamentals.

Step-by-step guide to opening an ISA

Opening an ISA account is straightforward and often doable online in minutes, beginning with eligibility checks and ending with funding. First, confirm you meet the criteria and select a type. Then, choose a provider by comparing rates via sites like MoneySavingExpert or directly on bank websites.

Gather required documents

Prepare your National Insurance number, a valid photo ID such as a passport or driving licence, and proof of address like a utility bill. These ensure compliance with anti-money laundering rules, as outlined on GOV.UK’s ISA opening guide. Digital copies often suffice for online applications.

Select a provider and compare options

Evaluate providers for interest rates, fees, and ease of access. For the best isa rates, check current AER figures—Cash ISAs might offer 4-5% in 2025, varying by fixed or variable terms. Use comparison tools to avoid low-yield options.

Complete the online or in-branch application

Most providers, including major banks, allow you to open an ISA online by filling out a form with personal details and declaring no other subscriptions exceed the allowance. In-branch options suit those preferring face-to-face help, though online is faster. Expect identity verification via app or post.

Fund your account

Transfer money from your current account or set up standing orders, up to £20,000 for the tax year. Confirm the tax year runs from 6 April to 5 April to maximise your allowance.

Tip: Avoid common mistakes when applying

Double-check your National Insurance number to prevent delays, and ensure you’re not over the allowance if transferring existing ISAs. Opt for providers protected by the FSCS for security.

How long does it take and what are the minimums?

Online applications to open an ISA typically take 5-10 minutes, with full activation in 1-3 business days after verification. In-branch processes might wrap up same-day but involve queues. Minimum deposits vary, but many allow starting with just £1, making it accessible for beginners.

Typical timelines for approval

Expect quicker processing from digital banks like Monzo, while traditional ones like HSBC may take longer for manual checks. As per Moneybox’s 2025 guide, act early in the tax year to avoid rushes.

Minimum deposit amounts by provider

| Provider | ISA Type | Minimum Deposit | Example Rate (2025) |

|---|---|---|---|

| Lloyds Bank | Cash ISA | £1 | 3.5% AER |

| Nationwide | Cash ISA | £1 | 4.0% AER |

| Halifax | Stocks & Shares ISA | £100 | Variable |

| HSBC | Cash ISA | £1 | 3.2% AER |

These figures are indicative; always verify current terms on provider sites like HSBC’s ISA page.

Common pitfalls to avoid

Overlooking fees or not confirming FSCS coverage can erode benefits—aim for no-fee options where possible.

Opening an ISA with major UK providers

For those wondering how to open an ISA with Lloyds, start via their app or website, selecting from Cash or Stocks options with a quick eligibility quiz. Nationwide simplifies the process for members, allowing instant online setup for their flexible ISAs, ideal for easy access. Halifax and HSBC follow similar digital paths, but HSBC requires a current account link for seamless transfers.

After opening: Managing and transferring your ISA

Once open, monitor your contributions to stay under the £20,000 limit, trackable via HMRC statements. Transfers to better rates are tax-free but count towards your allowance if adding new funds. For 2025, consider inflation-beating options to preserve value, consulting IG UK’s allowance explainer for strategies.

Frequently asked questions about opening an ISA

How old do you have to be to open an ISA?

You must be 18 or older to open a standard ISA, as per HMRC guidelines, to ensure you’re liable for taxes outside the wrapper. For younger savers, parents can open a Junior ISA from birth up to age 17, with funds accessible at 18. This age rule prevents misuse and aligns with UK tax residency for adults, with no exceptions announced for 2025.

How much money do I need to open an ISA?

Many providers let you start with as little as £1, lowering barriers for new savers, though some like investment platforms require £100 for Stocks and Shares ISAs. Check specifics, as minimums ensure viability without high entry costs. This flexibility helps build habits, but remember the £20,000 annual cap applies regardless of initial deposit.

How long does it take to open an ISA?

Completing the application online takes 5-10 minutes, but verification and activation span 1-3 business days, depending on the provider’s processes. Digital banks expedite this via app-based ID checks, while traditional ones might need postal documents. Planning ahead avoids tax-year-end delays, ensuring you maximise your allowance promptly.

Can I open an ISA online?

Yes, most UK providers support fully online applications, from major banks like Lloyds to platforms like Hargreaves Lansdown, making it convenient for tech-savvy users. Upload documents digitally for quick approval, often within hours. This method suits the growing trend of remote banking, but in-branch remains for those needing assistance.

What documents are needed to open an ISA?

Essential items include your National Insurance number for tax declaration, photo ID like a passport, and address proof such as a bank statement. These meet KYC standards to combat fraud, as detailed on official sites. Have them ready to speed up the process, especially for online how to open an ISA account setups.

How do I open an ISA for a child?

Parents or guardians can open a Junior ISA online or via post with the child’s details, no minimum age required up to 17, focusing on long-term growth. Provide your ID and the child’s birth certificate, with contributions up to £9,000 annually tax-free. Funds mature at 18, offering a secure nest egg; compare GOV.UK’s Junior ISA guide for options.

Can I transfer an existing ISA when opening a new one?

Yes, transfers are straightforward and preserve tax-free status, done via the new provider without using your current allowance if no new funds added. This is useful for chasing better rates in 2025’s variable market, but full transfers avoid partial allowance hits. Experts recommend annual reviews to optimise returns, consulting HMRC for complex multi-ISA moves.