What is an ISA and why use one?

An Individual Savings Account, or ISA, is a tax-free savings or investment account available to UK residents. It allows you to save or invest up to a set amount each year without paying income tax or capital gains tax on the returns. Understanding the different types of ISA accounts can help you make informed decisions about growing your money securely.

Definition and tax benefits

ISAs come in various forms, but all share the core benefit of tax-free growth. For instance, interest earned on savings or gains from investments are not taxed, unlike standard savings accounts where interest might fall under income tax. This makes ISAs particularly appealing for anyone looking to maximise their savings, especially with the current high interest rates. As explained on GOV.UK, the ISA meaning revolves around shielding your earnings from HMRC taxation.

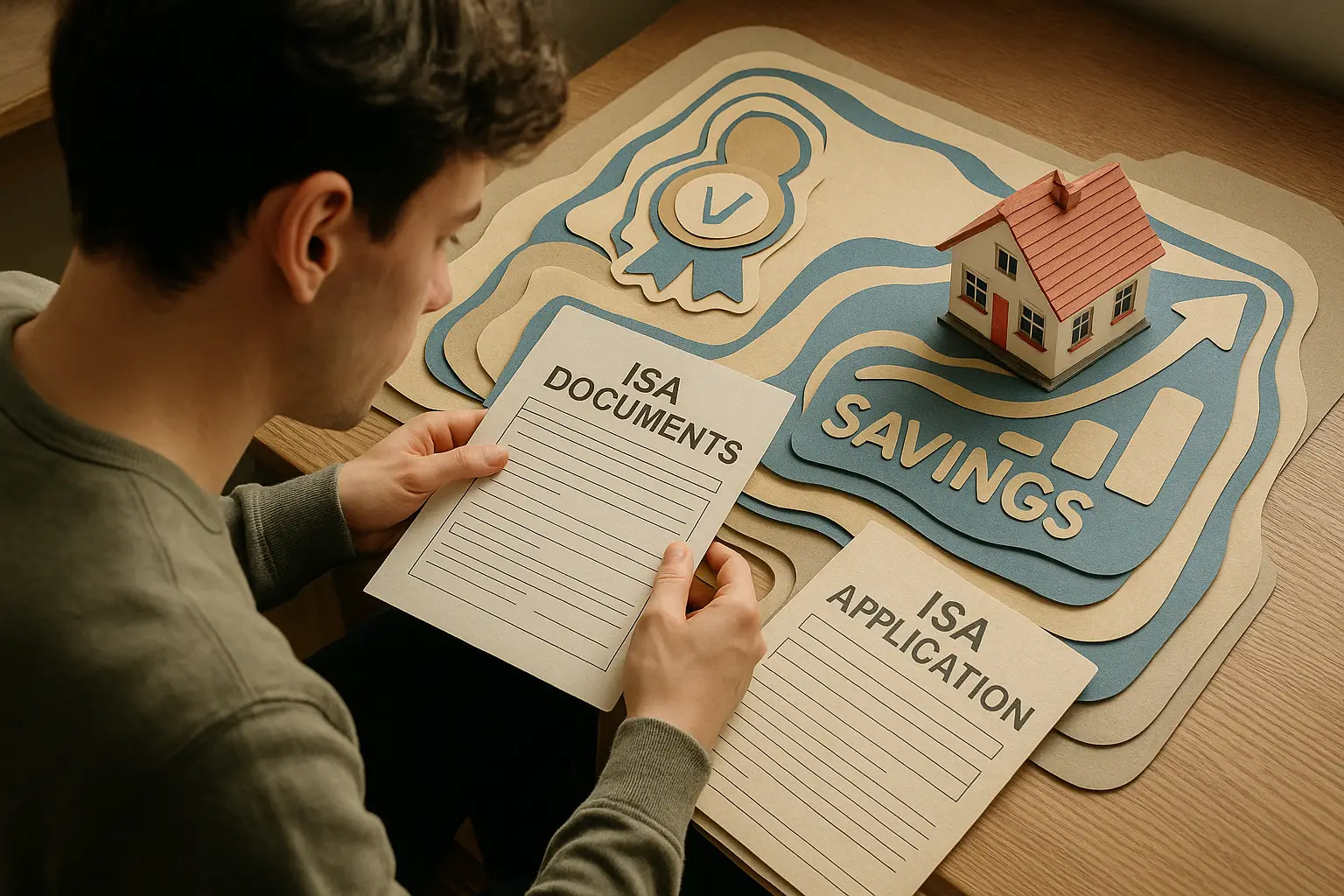

Eligibility and basics

To open an ISA, you must be 18 or over and a UK resident for tax purposes, as regulated by the FCA. Non-residents or those under 18 may have limited options, like Junior ISAs for children. Start by checking your eligibility through providers such as HSBC or Nationwide, which offer straightforward explanations for beginners.

Current allowance overview

The ISA allowance for 2024/25 stands at £20,000, meaning you can contribute this amount across all your ISAs in a tax year, which runs from 6 April to 5 April. This limit applies to adults, with Junior ISAs having a separate £9,000 allowance. For more on what is an ISA, explore official guidelines.

The main types of ISA accounts

There are five principal types of ISA accounts in the UK: cash, stocks and shares, lifetime, junior, and innovative finance. Each suits different financial goals, from safe saving to higher-risk investing. Below, we break down the different types of ISA accounts to help you identify the best fit.

Cash ISA

A Cash ISA functions like a regular savings account but with tax-free interest. It is ideal for those seeking low-risk options, offering easy access or fixed terms. As of October 2025, top cash ISA rates reach up to 4.92% AER, according to Tembo Money, making it a strong choice for preserving capital while earning steady returns.

Stocks and shares ISA

This type invests in stocks, shares, funds, or bonds, potentially offering higher returns but with market volatility. It suits those comfortable with risk for long-term growth. Unlike cash ISAs, returns are not guaranteed, but all gains remain tax-free.

Lifetime ISA

Designed for 18- to 39-year-olds saving for a first home or retirement, the Lifetime ISA adds a 25% government bonus on contributions up to £4,000 annually, capped at £1,000 bonus. Withdrawals for approved uses are penalty-free, but others incur a 25% charge. This makes it a boosted option within the types of ISA accounts UK residents can access.

Junior ISA

A Junior ISA is for children under 18, opened by parents or guardians, with tax-free growth until the child turns 18. It comes in cash or stocks and shares variants, with a £9,000 annual limit. Funds become accessible at 18, promoting early saving habits.

Innovative finance ISA

This niche type covers peer-to-peer lending or crowdfunding, offering potentially higher yields than cash ISAs but with elevated risks like borrower defaults. It appeals to diversified portfolios, though less common among the types of ISA accounts.

| Type | Key features | Risk level | Suitability |

|---|---|---|---|

| Cash ISA | Tax-free interest, easy access or fixed | Low | Short-term savers |

| Stocks and shares ISA | Invest in markets, potential growth | Medium to high | Long-term investors |

| Lifetime ISA | Government bonus, home/retirement focus | Low to high (depending on type) | First-time buyers aged 18-39 |

| Junior ISA | For under 18s, tax-free until maturity | Low to high | Parents saving for children |

| Innovative finance ISA | P2P lending, higher yields | High | Experienced diversifiers |

How to choose the right ISA for you

Selecting among the types of ISA accounts depends on your financial objectives, risk tolerance, and timeline. Start by assessing your needs—safety or growth?—then compare options.

Based on goals (saving vs investing)

If preserving capital is key, opt for a cash ISA for guaranteed interest without stock market dips. For building wealth over time, a stocks and shares ISA allows investment in diverse assets. Lifetime ISAs bridge both for specific life events like buying a home.

Risk levels

Low-risk profiles suit cash or Junior ISAs, protected up to £85,000 by the FSCS. Higher risk-takers might choose stocks and shares or innovative finance for potentially greater rewards, but with possible losses. Always align with your comfort level.

Current best rates

Cash ISA rates vary, with the highest at 4.92% AER in 2025, though they fluctuate. For the latest comparisons, visit best isa rates guides. Stocks and shares ISAs focus on performance rather than fixed rates.

ISA rules, allowances, and limits

Navigating ISA rules ensures compliance and maximises benefits. Key regulations from HMRC guide contributions and usage.

2024/25 allowance details

You can save up to £20,000 total across all ISA types in the 2024/25 tax year. Unused allowance does not carry over, so plan accordingly. UK households contributed a record £103 billion in 2023-24, per GOV.UK statistics.

Multiple ISAs allowed?

You can hold multiple ISAs but subscribe to only one of each type per tax year, as per GOV.UK rules. For example, one cash ISA and one stocks and shares ISA subscription annually, but more if previously held.

Transfers and withdrawals

Transfers to another provider keep tax-free status intact, often without affecting allowance. Withdrawals are flexible except in Lifetime ISAs, where penalties apply outside permitted uses. Always confirm with your provider.

Frequently asked questions

What is the difference between a Cash ISA and a Stocks and Shares ISA?

A Cash ISA offers tax-free interest on deposits, similar to a savings account with low risk and predictable returns. In contrast, a Stocks and Shares ISA invests in markets for potential higher growth but involves volatility and possible capital loss. Beginners often start with Cash ISAs for stability, while experienced savers diversify into Stocks and Shares for long-term wealth building, as outlined in Forbes Advisor UK guides.

How many ISAs can I have?

There is no limit to the total number of ISAs you can hold, but you can only contribute to one of each type per tax year. For instance, you might have several Cash ISAs from different providers but subscribe to just one new or existing Cash ISA annually. This flexibility allows portfolio management without breaching rules, according to FCA regulations.

What is the ISA allowance for 2024/25?

The annual ISA allowance is £20,000 for the 2024/25 tax year, applicable across all adult ISA types. Contributions exceeding this lose tax-free status on the excess. With inflation and policy changes, always verify via HMRC for updates, ensuring you maximise tax-efficient saving.

Which ISA is best for beginners?

For beginners, a Cash ISA is typically ideal due to its low risk and simplicity, providing steady tax-free interest without investment knowledge. It suits those new to saving, offering easy access to funds. However, if planning long-term, consider a Stocks and Shares ISA with professional advice to balance growth and security.

Can I transfer my ISA to another provider?

Yes, you can transfer ISAs between providers without losing tax benefits, either fully or partially. The process is free if done correctly, preserving your allowance for the year. It’s useful for chasing better rates, but check terms to avoid invalidation, as per MoneySavingExpert recommendations.

What happens if I exceed the ISA allowance?

Exceeding the £20,000 limit means the excess contributions are not tax-free and may incur penalties or void the entire ISA. HMRC can reclaim tax on unauthorised amounts, so track contributions meticulously. To avoid issues, use tools from providers like Nationwide for monitoring.

What are the different types of ISA accounts UK residents can open?

UK residents aged 18+ can open Cash, Stocks and Shares, Lifetime, and Innovative Finance ISAs, plus Junior ISAs for children. Each type targets specific needs, from safe saving to alternative investments. With five main options, selecting based on goals ensures optimal use of the tax-free wrapper.