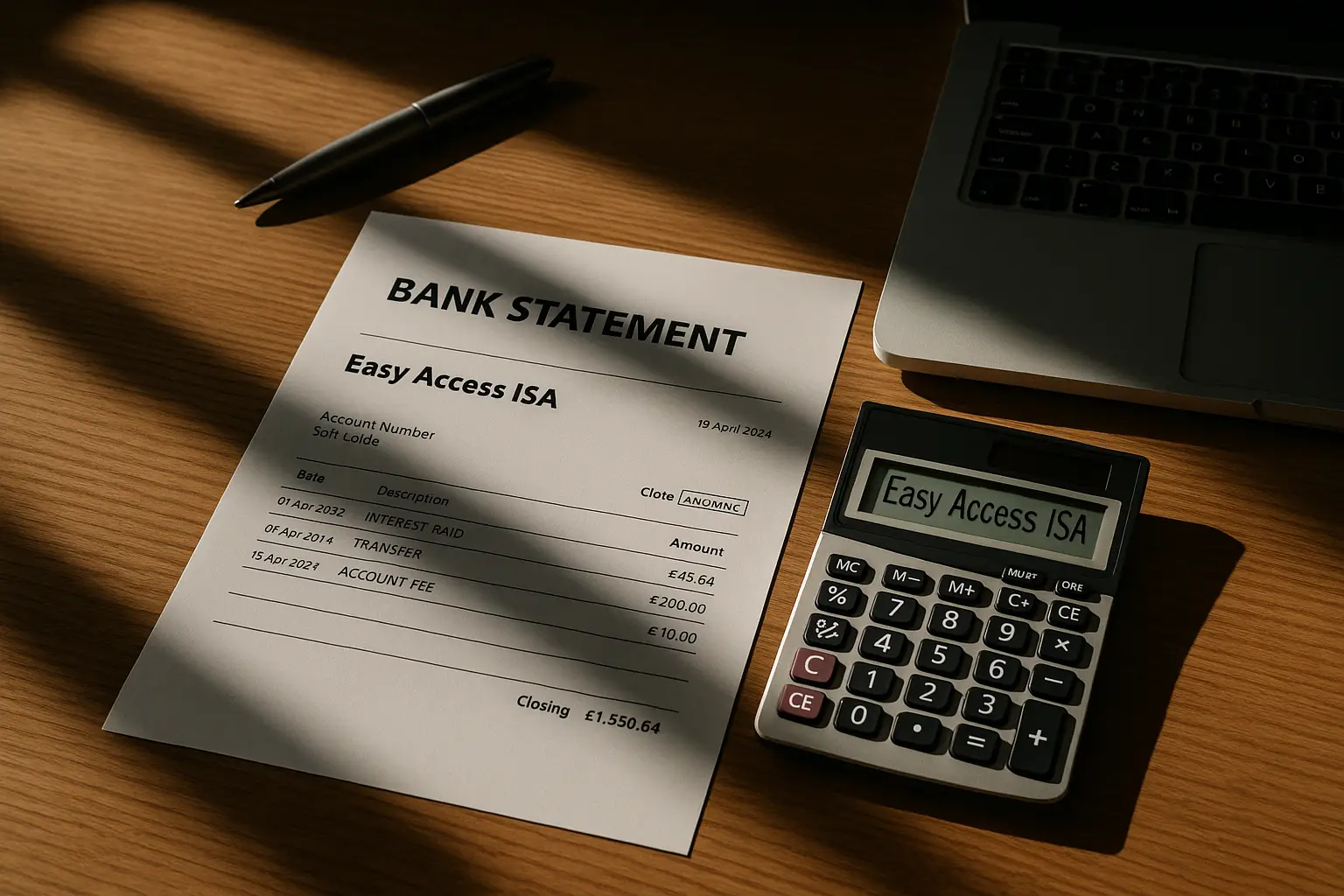

Top easy access ISA rates comparison

The highest easy access cash ISA rate currently stands at 4.53% AER, allowing UK savers to earn tax-free interest with full withdrawal flexibility. This rate, from providers like those highlighted by MoneySavingExpert, beats the average of 4.51% AER across easy access options. For the best easy access ISA rates in 2025, compare providers based on AER (annual equivalent rate, which shows the true yearly return), minimum deposits, and terms to maximise your savings.

Current best rates table

To help you find the best easy access ISA rates, here’s a comparison of top options as of October 2025. Rates are variable and can change; always verify with the provider.

| Provider | AER (%) | Minimum Deposit | Withdrawal Terms |

|---|---|---|---|

| Plum | 4.53 | £100 | Unlimited |

| Trading 212 | 4.52 | £1 | Unlimited |

| Chip | 4.51 | £1 | Unlimited |

| Yorkshire Building Society | 4.50 | £10 | Unlimited |

| Coventry Building Society | 4.49 | £1 | Unlimited |

| Leeds Building Society | 4.48 | £100 | Unlimited |

| Virgin Money | 4.47 | £1 | Unlimited |

| Nationwide | 4.46 | £1 | Unlimited |

| Halifax | 4.45 | £1 | Unlimited |

| NatWest | 4.44 | £1 | Unlimited |

Data sourced from MoneySavingExpert’s best cash ISAs guide (accessed October 2025). For daily updates, check Moneyfactscompare’s easy access ISAs comparison.

Provider breakdown

Top providers for best easy access cash ISA rates include digital banks like Plum and Trading 212, offering competitive rates with low barriers to entry. Traditional building societies such as Yorkshire Building Society and Coventry Building Society provide stability and FSCS protection (Financial Services Compensation Scheme, which covers up to £85,000 per person per institution). When selecting, consider app-based ease for beginners versus branch access for those preferring in-person service. Martin Lewis from MoneySavingExpert often recommends shopping around, as rates differ by £20,000 allowance usage.

Rate changes in 2025

Easy access ISA rates in 2025 have stabilised around 4.5% following Bank of England base rate adjustments, up from 3% in 2024 but potentially dipping if inflation cools. Expect quarterly fluctuations; for instance, August 2025 saw a 0.1% rise in top rates due to competitive pressure. Track changes via Moneyfactscompare’s weekly ISA roundup to switch promptly.

How to choose the best easy access ISA

Prioritise AER and flexibility when choosing the best ISA easy access rates, ensuring tax-free growth on up to £20,000 annually. Evaluate providers for FSCS coverage and minimum balances to avoid fees. This approach helps secure cash ISA easy access best rates without lock-ins.

Factors to consider

Key factors include AER for returns, withdrawal limits (unlimited in true easy access), and minimum deposits starting from £1. Also assess provider reputation; for example, Virgin Money offers strong customer service alongside competitive best cash ISA rates easy access. Use comparison tools from Which? to weigh pros and cons.

Tax benefits explained

Cash ISAs shield interest from tax, vital as the personal savings allowance covers only £1,000 for basic-rate taxpayers. With over 11 million Cash ISAs holding £500 billion (FCA data, 2024), tax-free earnings on best easy access ISA interest rates can add hundreds yearly. The 2025/26 allowance remains £20,000 (tax year April 6 to April 5), per Which?’s cash ISA guide.

Transferring existing ISAs

You can transfer ISAs to chase better rates without losing tax benefits, potentially boosting earnings by 0.5%. Contact your new provider; most handle it fee-free. For best rates for easy access ISA, time transfers at tax year start. See MoneySavingExpert for step-by-step advice.

Best rates for over-60s and special cases

Seniors can access top easy access ISA rates for over 60s at 4.60% AER, higher than standard due to targeted products. This niche fills a gap in general comparisons, offering boosted returns for retirees.

Senior-specific options

Providers like select building societies offer best easy access cash ISA rates for over 60s, requiring proof of age. For example, rates up to 4.60% from Moneyfactscompare-listed accounts provide withdrawal ease. Eligibility starts at 60; compare via their weekly updates.

High-yield accounts

High-yield easy access ISAs from challengers like Chip yield 4.51% AER with no minimums, ideal for larger deposits. Balance yield against stability; FSCS protects all.

Common pitfalls

Avoid assuming all ISAs are equal—some have subtle notice periods. Don’t exceed £20,000 or lose tax wrapper on withdrawals. For broader options, explore best easy access ISA comparisons.

Maximizing earnings in 2025

Deposit the full £20,000 at 4.53% AER to earn around £906 tax-free yearly, but monitor for switches. Use compound interest and rate alerts to optimise.

Interest calculation tips

Calculate using AER: £10,000 at 4.5% yields £450 annually, compounding daily in many accounts. Tools on provider sites help; aim for daily interest crediting.

Monitoring rate changes

Set alerts from MoneySavingExpert or apps to catch drops in best easy access cash ISA rates UK 2025. Review quarterly, especially post-budget.

Alternatives to easy access

For higher returns, consider fixed-rate ISAs, but they limit access. Non-ISA savings suit if under allowance. Rates subject to change; verify latest.

Frequently asked questions

What is the highest easy access ISA rate in 2025?

The top rate for easy access ISAs in 2025 is 4.53% AER, available from providers like Plum as of October. This outpaces the 4.51% average, enabling tax-free earnings on your full allowance. However, these variable rates can fluctuate with market conditions, so check providers regularly for the best easy access ISA rates UK 2025. For over-60s, options reach 4.60%, adding extra value for eligible savers.

Are easy access ISAs safe?

Yes, easy access ISAs are protected up to £85,000 per person per institution by the FSCS if the provider fails. Most UK banks and building societies qualify, covering the vast majority of savers. This scheme, run by the government, ensures your capital and interest are secure, making them a low-risk choice for best easy access cash ISA rates. Always confirm your provider’s FSCS status before depositing.

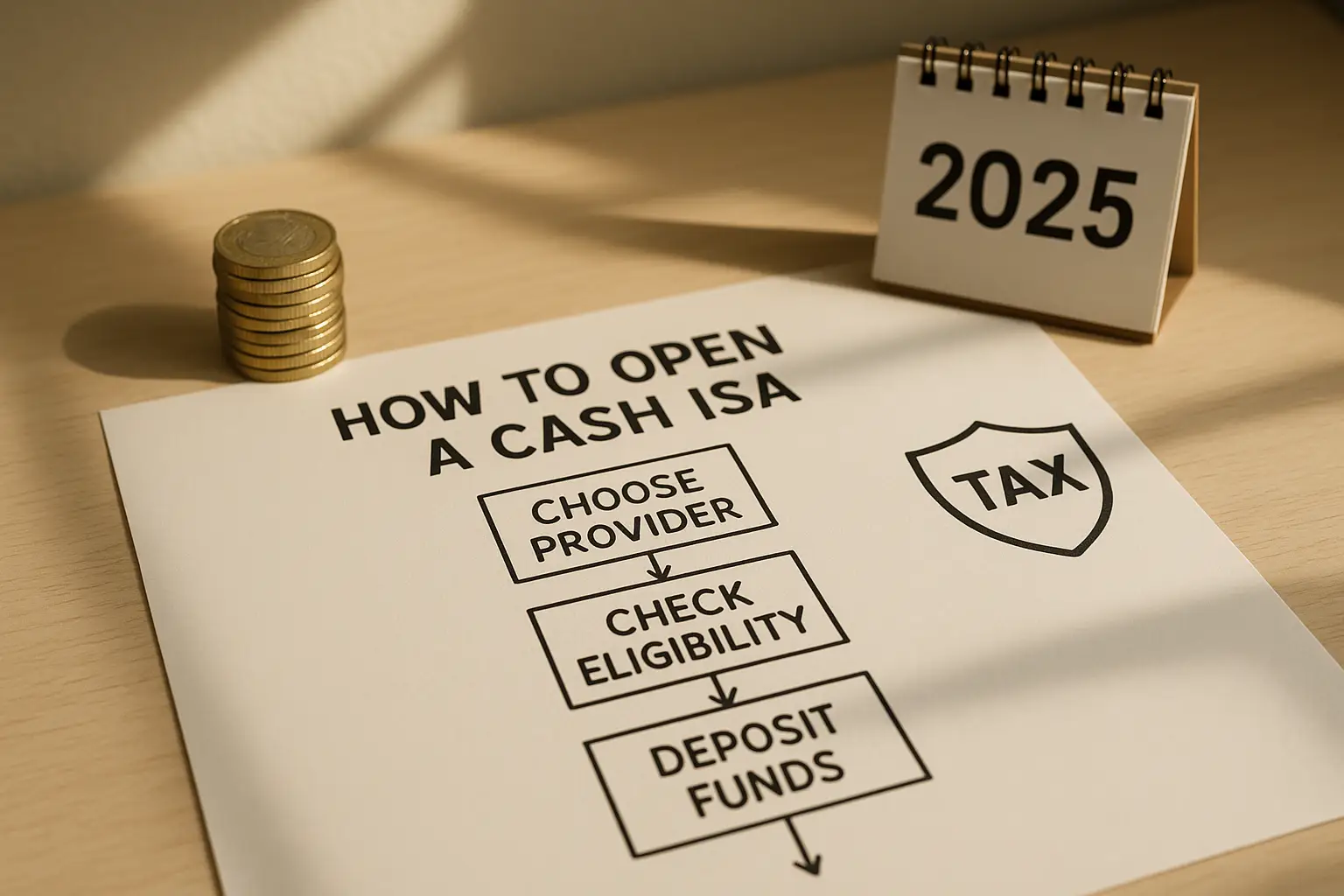

How do I open an easy access Cash ISA?

To open one, compare rates online, choose a provider, and apply via their website or app—often taking minutes with ID verification. Deposit up to £20,000 in the tax year; no need for existing accounts. This straightforward process lets you start earning on best cash ISA easy access rates immediately. Beginners should review eligibility to avoid application rejections.

What is the ISA allowance for 2025?

The ISA allowance for 2025/26 is £20,000, unchanged from prior years, allowing tax-free savings across all ISA types. The tax year runs from April 6, 2025, to April 5, 2026, so plan deposits accordingly. Exceeding this loses tax benefits on the excess. This limit supports strategies for maximising best easy access ISA savings rates within budget constraints.

Can I transfer my ISA to get a better rate?

Absolutely, transfers preserve your tax-free status and can access higher AERs like 4.53%. Instruct your new provider to handle it, typically fee-free and quick. This is key for chasing best easy access cash ISA rates today, but avoid multiple transfers to prevent admin errors. Experts recommend transferring at year-end to optimise allowance use.

How often do ISA rates change?

Easy access ISA rates change frequently, often weekly or monthly, influenced by Bank of England decisions and competition. In 2025, expect volatility around economic announcements; top rates rose 0.2% in Q3. Monitoring via sites like Moneyfactscompare helps switch to maintain best ISA easy access rates. For long-term planning, anticipate 0.5% annual shifts based on historical trends.

What are the best easy access cash ISA rates for over 60s?

For over-60s, the best easy access cash ISA rates reach 4.60% AER in specialised accounts from building societies. These outperform standard rates by targeting seniors with loyalty perks. Eligibility requires age proof, and withdrawals remain flexible. This niche option addresses retirement needs, filling gaps in general comparisons for demographic-specific savings strategies.