Best Lifetime ISA providers in 2025: top picks compared

Choosing the best Lifetime ISA in 2025 can supercharge your savings for a first home or retirement, thanks to the government’s 25% bonus on contributions up to £4,000 annually. With rates fluctuating due to Bank of England decisions and over 500,000 accounts already open since 2017, this guide compares top UK providers like Paragon Bank for cash options and AJ Bell for stocks and shares. Whether you’re a first-time buyer eyeing the £450,000 home limit or a saver seeking the best Lifetime ISA rates, we’ll break down fees, AER (annual equivalent rate, a standard measure of interest), and expert picks from sources like MoneySavingExpert to help you decide.

What is a Lifetime ISA and who is it for?

A Lifetime ISA (LISA) is a tax-free savings account designed for UK residents aged 18 to 39, helping build a deposit for a first home under £450,000 or retirement funds from age 60. Unlike standard ISAs, it offers a 25% government bonus on contributions, turning your £4,000 yearly limit into £5,000 instantly—up to £1,000 extra per tax year. It’s ideal for first-time buyers or long-term savers who can lock away funds without penalty for qualifying uses, as detailed on the official GOV.UK Lifetime ISAs page.

Eligibility criteria

To open a LISA, you must be 18-39 and a UK resident, with no age limit for ongoing contributions until 50. First-time buyers qualify for penalty-free withdrawals on homes up to £450,000, but non-qualifying access incurs a 25% charge that claws back the bonus plus extra. This setup suits young professionals or families saving steadily, but check your status if you’ve owned property before.

Key benefits including 25% bonus

The standout perk is the immediate 25% bonus, adding £1,000 to a max £4,000 contribution—far better than standard cash ISAs at around 4-5% AER. Tax-free growth compounds over time, and for retirement, funds grow untouched until 60. Martin Lewis highlights this in his guides, noting it’s a “no-brainer” for eligible savers aiming for the best Lifetime ISA UK 2025 options.

Differences from Help to Buy ISA

Help to Buy ISAs closed to new savers in 2019, offering a smaller 25% bonus on up to £12,000 total but limited to £200,000 homes. LISAs provide ongoing flexibility for higher-value properties and retirement, with easier transfers available. If you have a Help to Buy ISA, transferring to a LISA preserves your bonus, as explained by MoneySavingExpert.

How Lifetime ISAs work in 2025

In 2025, the LISA allowance remains £4,000 within the overall £20,000 ISA limit, with the bonus claimed automatically by providers within 30 days of contribution. Withdrawals for homes or age 60 are penalty-free, but others face a 25% charge to recover the bonus and deter misuse. Tax advantages mean all interest and gains are sheltered, making it a strong choice amid expected stable rates post-Bank of England adjustments.

Allowance and contribution rules

Contribute up to £4,000 from 6 April to 5 April next year, earning the full £1,000 bonus if eligible. You can split across cash and stocks and shares LISAs, but the total LISA cap is £4,000. For the best Lifetime ISA providers UK 2025, choose ones with low minimum deposits like Moneybox at £1.

Withdrawal penalties

Penalty-free only for first homes (£450,000 max) or from 60; otherwise, lose 25% of the total pot, including your contributions. This rule protects the scheme’s intent, per FCA guidelines. Plan carefully if your goals shift, as early access could wipe out gains.

Tax advantages

All growth is tax-free, unlike regular savings hit by personal savings allowances. This edges out non-ISA accounts, especially for higher earners. For deeper ISA basics, see our general ISA guide.

Tip: Start small with monthly contributions to maximise the bonus over time— even £100/month qualifies for £300 extra yearly from the government.

Best cash Lifetime ISA rates 2025

The top cash LISA rate in 2025 hits 4.30% AER from Paragon Bank, beating inflation and providing low-risk growth for conservative savers seeking the best Lifetime ISA rates. These accounts suit first-time buyers wanting steady deposits without market volatility. Rates are variable, so monitor changes via aggregators for the best cash Lifetime ISA options.

Top providers ranked by AER

- Paragon Bank: 4.30% AER, no fees, £1 minimum—leads for the best Lifetime ISA interest rates.

- Moneybox: 4.20% AER, app-based ease, ideal for beginners.

- OneFamily: 4.10% AER, flexible access within rules.

Pros and cons

Cash LISAs offer security via FSCS protection up to £85,000, but returns may lag stocks over decades. Pros include simplicity and bonus boost; cons are lower potential vs. investments. For current deals, check Moneyfactscompare.

Current interest rates

As of October 2025, expect 4-4.30% AER amid steady base rates, per industry data. This outpaces standard savings, enhanced by the bonus for effective yields over 5% initially.

Best stocks and shares Lifetime ISA providers

For growth potential, the best stocks and shares Lifetime ISA providers like AJ Bell charge just 0.25% platform fees with 0.25% on uninvested cash, suiting risk-tolerant savers. These invest in funds or shares, potentially doubling money long-term but with volatility. Ideal if your horizon is 5+ years for home or pension goals.

Investment options and fees

Choose from thousands of funds; AJ Bell offers low-cost index trackers. Fees average 0.25-0.45%, far below active management. Hargreaves Lansdown provides expert tools but higher costs at 0.45%.

Recommended platforms

- AJ Bell: Top for low fees and choice, per Ecommerce Accountants reviews.

- Moneybox: Easy app investing, great for the best Lifetime ISA stocks and shares.

- Hargreaves Lansdown: Robust research for advanced users.

Risk considerations

Markets can fall 20%+ short-term, but historical 7% annual returns beat cash. Diversify to mitigate; not for near-term needs. For alternatives, explore our stocks and shares ISA guide.

Top Lifetime ISA providers compared

Comparing providers reveals AJ Bell and Paragon as standouts for 2025, balancing fees, rates, and bonuses. Martin Lewis recommends flexible options via MoneySavingExpert for the best Lifetime ISA UK. Updates include slight rate hikes post-budget.

| Provider | Type | AER/Yield | Fees | Min Deposit | Bonus Eligible |

|---|---|---|---|---|---|

| Paragon Bank | Cash | 4.30% | None | £1 | Yes |

| AJ Bell | Stocks & Shares | Variable (0.25% cash) | 0.25% | £500 | Yes |

| Moneybox | Both | 4.20% cash | 0.45% + fund fees | £1 | Yes |

| Hargreaves Lansdown | Stocks & Shares | Variable | 0.45% | £100 | Yes |

Data from Which? and Moneyfacts; always verify latest terms.

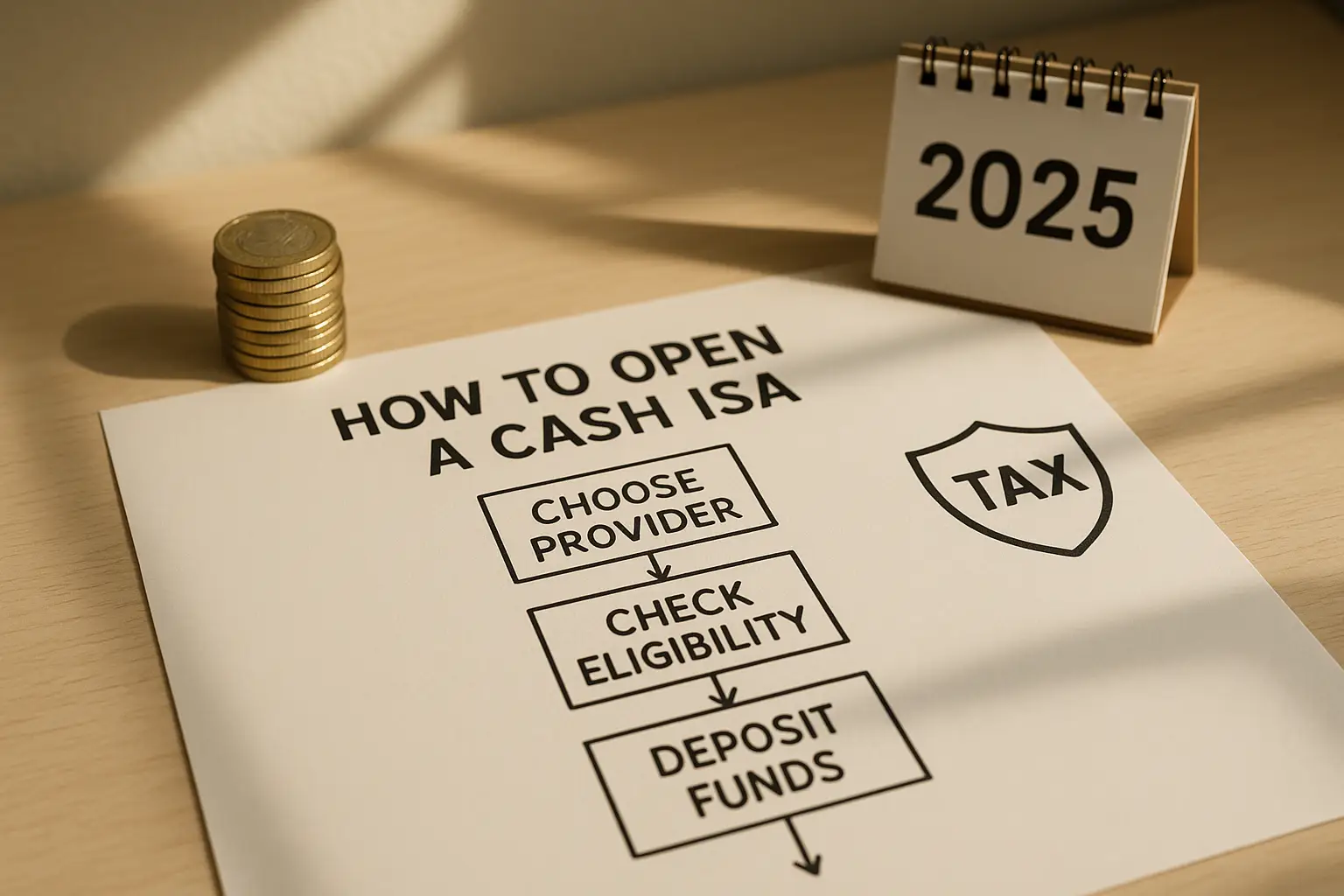

How to choose and open the best Lifetime ISA

Select based on risk: cash for safety, stocks for growth, prioritising low fees and high AER for the best Lifetime ISA providers UK 2025. First-time buyers should factor bonus impact on deposits. Transfer from old ISAs seamlessly to avoid penalties.

Factors for first-time buyers

Aim for easy-access cash if buying soon; otherwise, invest for higher returns. Consider apps like Moneybox for tracking. Avoid high-fee traps that erode bonuses.

Transferring existing ISAs

Move Help to Buy or cash ISAs to a LISA free of charge; bonus applies to new contributions only. Providers handle this, per GOV.UK rules. It’s a smart move for consolidating into the best Lifetime ISA account.

Common mistakes to avoid

Don’t withdraw early without qualifying, as the 25% hit stings. Overlook fees that nibble returns, and always contribute by tax year-end. For housing tips, see our first-time buyer schemes guide.

Frequently asked questions

What is a Lifetime ISA?

A Lifetime ISA is a government-backed savings vehicle for UK residents aged 18-39, allowing tax-free contributions up to £4,000 yearly plus a 25% bonus for home purchases under £450,000 or retirement from 60. It combines cash and investment options, differentiating from regular ISAs by the bonus incentive and specific withdrawal rules. With over 500,000 opened since 2017, it’s popular for long-term goals, though penalties apply for non-qualifying access, making it essential for committed savers.

How does a Lifetime ISA work?

You contribute up to £4,000 annually, receiving an instant 25% bonus from HMRC, then your money grows tax-free in cash or stocks. Withdrawals are restricted to first homes or age 60 without penalty; otherwise, a 25% charge applies to recoup the bonus. In 2025, no major changes are expected, but monitor allowances via official sources for seamless operation.

What is the Lifetime ISA bonus?

The bonus is a 25% government top-up on contributions, max £1,000 per year on £4,000 saved, claimed automatically by providers. It applies only to eligible 18-39-year-olds and boosts home deposits significantly—for example, £10,000 saved becomes £12,500. Unlike Help to Buy, it’s available yearly, enhancing the appeal for the best Lifetime ISA for first-time buyers.

Can I transfer a Help to Buy ISA to a Lifetime ISA?

Yes, transfers are allowed without losing your existing bonus, moving the pot into a LISA for continued growth and new contributions. The process is free if done directly between providers, preserving eligibility for higher home values up to £450,000. This upgrade makes sense for ongoing saving, as advised by experts like Martin Lewis on MoneySavingExpert.

What are the best Lifetime ISA rates in 2025?

Top cash rates reach 4.30% AER from Paragon Bank, with stocks and shares offering variable returns around 5-7% historically via low-fee platforms like AJ Bell. For the best Lifetime ISA rates UK 2025, prioritise AER for cash or projected yields for investments, factoring in the bonus for effective gains over 5%. Rates can shift with economic policy, so compare via sites like Moneyfacts for real-time data.

What’s the difference between cash and stocks Lifetime ISAs?

Cash LISAs provide guaranteed low-risk interest like 4.30% AER, protected by FSCS, ideal for short-term home buys. Stocks and shares LISAs invest in markets for higher potential returns but with volatility, suiting long-term horizons like retirement. Choose cash for stability in the best cash Lifetime ISA, or stocks for growth in the best stocks and shares Lifetime ISA, balancing your risk tolerance and timeline.

Can I open a Lifetime ISA if I’m over 39?

No, new openings are limited to ages 18-39, but if you already have one, you can contribute until 50. This rule targets younger savers for housing or pensions, per HMRC. Over-39s should consider standard ISAs or pensions instead for similar tax benefits without the bonus.