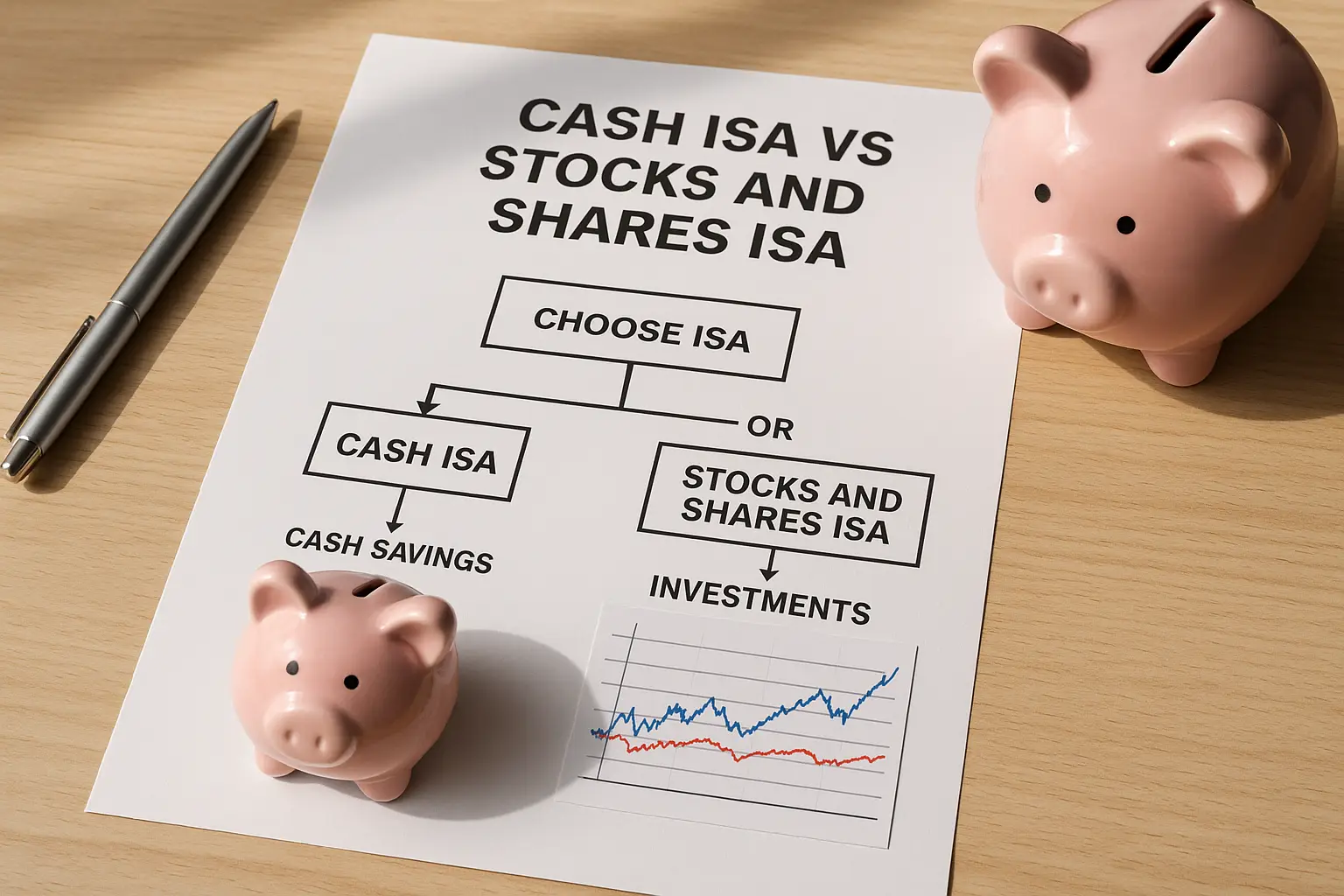

Understanding ISA types and rates

Individual Savings Accounts, or ISAs, allow UK residents to save or invest up to £20,000 tax-free each tax year. When you compare ISA rates, focus on the Annual Equivalent Rate (AER), which shows the true return accounting for compounding interest. Cash ISAs offer straightforward savings with variable or fixed rates, while others like stocks and shares ISAs involve higher risk for potential growth.

Cash versus fixed rate ISAs

Cash ISAs provide easy access to funds with variable rates that can change, currently topping at 4.51% AER for easy access options as of October 2025 (source: Moneyfactscompare.co.uk, accessed 2025-10-15). Fixed rate ISAs lock your money for a set period, like one to five years, guaranteeing rates up to 4.27% AER, ideal if you anticipate falling base rates. To compare cash ISA rates effectively, weigh flexibility against security; easy access suits short-term needs, while fixed protects against rate drops but may penalise early withdrawals.

Junior and lifetime ISAs overview

Junior ISAs are for children under 18, with parents or guardians managing up to £9,000 annually tax-free, though rates for compare junior ISA rates remain modest around 4% AER. Lifetime ISAs (LISAs) target first-time buyers or retirement savers aged 18-39, offering a 25% government bonus on contributions up to £4,000 yearly, but compare lifetime ISA rates show cash versions at about 4% with withdrawal penalties before age 60. These specialist types complement standard cash ISAs for long-term goals.

Current allowance and tax benefits

The ISA allowance stands at £20,000 for 2025, covering all types combined, making it essential to compare ISA rates UK to maximise tax-free growth. Interest earned in ISAs avoids personal savings allowance taxes, benefiting basic-rate taxpayers most. For details on the ISA allowance 2025, consult official guidelines.

Top cash ISA rates comparison

The highest easy access cash ISA rates hit 4.51% AER in 2025, outperforming standard savings amid base rate stability (source: GOV.UK annual savings statistics, September 2025). Providers like those listed on Moneyfactscompare.co.uk lead, but always verify eligibility.

Easy access options

Easy access cash ISAs allow withdrawals without penalty, perfect for compare cash ISA rates where liquidity matters. Top rates include 4.4% AER from select building societies, beating inflation slightly. Use tools to compare cash ISA interest rates daily for updates.

Best providers and AERs

Here’s a comparison table of top easy access cash ISA rates as of October 2025 (data from Moneyfactscompare.co.uk and Money.co.uk, accessed 2025-10-15):

| Provider | AER (%) | Min Deposit | Access Type |

|---|---|---|---|

| Yorkshire Building Society | 4.51 | £1 | Easy Access |

| Nationwide | 4.40 | £1 | Easy Access |

| HSBC | 4.00 | £1 | Easy Access |

| Barclays | 3.50 | £100 | Easy Access |

| Principality | 4.20 | £500 | Easy Access |

These rates apply to UK residents; FSCS protects up to £85,000 per provider.

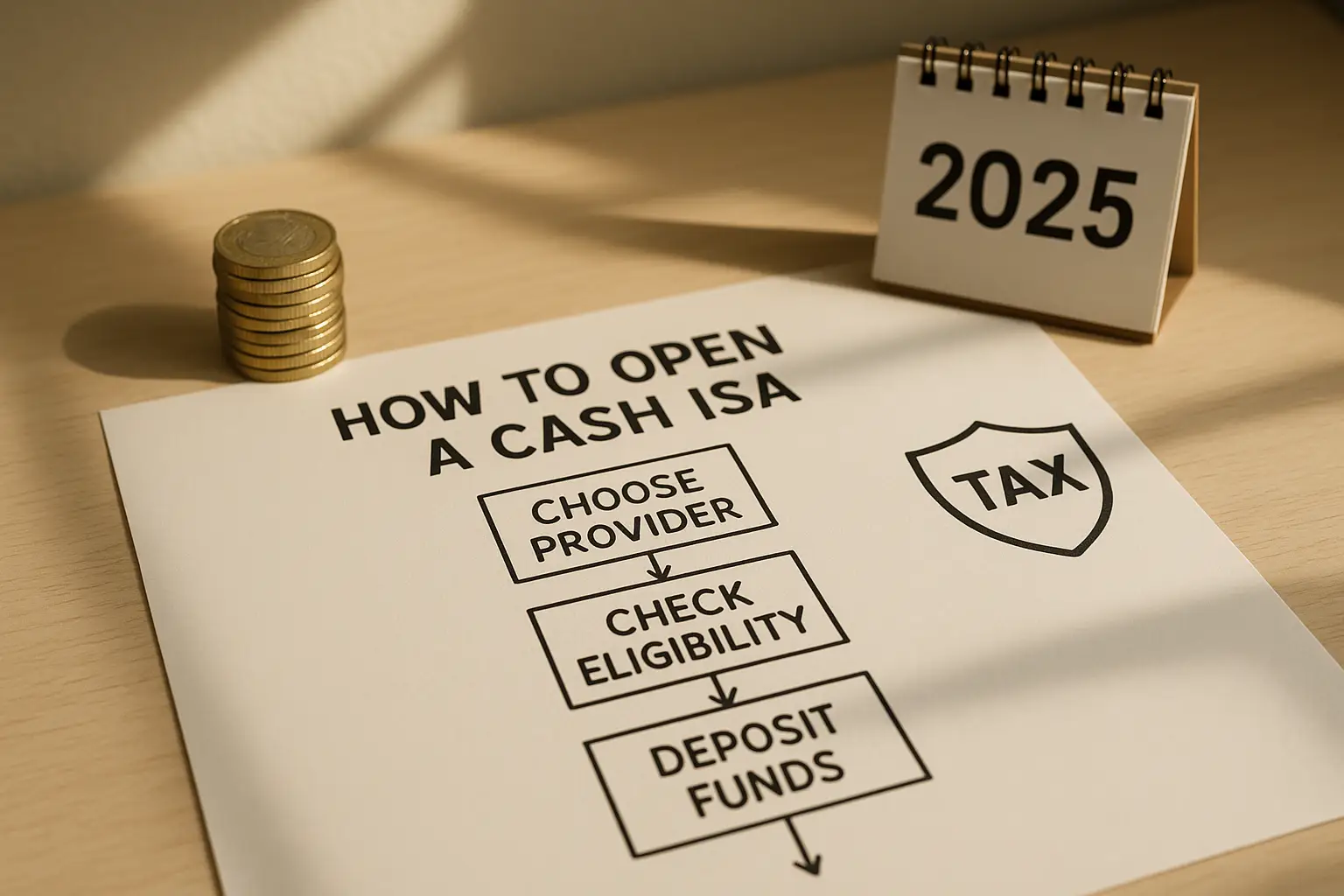

How to switch or transfer

Transferring ISAs is free and preserves tax-free status; contact your new provider to handle it. Steps include checking for bonuses on switches and comparing transfer rates to avoid dips. For guidance on how to open an ISA, start online.

Tip: Before transferring, confirm the receiving ISA’s rate exceeds your current one by at least 0.5% to cover any short-term gaps.

Fixed rate ISA comparisons

Fixed rate ISAs secure returns like 4.27% AER for five years, shielding from rate cuts expected in late 2025 (source: Moneyfactscompare.co.uk fixed-rate ISAs page, accessed 2025-10-15). Compare fixed rate ISA rates by term to match your horizon.

One-year versus longer terms

One-year fixed ISAs offer around 4.00% AER, suitable for short commitments, while five-year terms reach 4.27% but limit access. Longer fixes yield more if rates fall, per Tembo analysis projecting up to 4.92% peaks early 2025.

Rate tables by provider

For fixed options, Yorkshire Building Society leads at 4.27% for longer terms (source: Tembo, 2025). Compare providers via Moneyfactscompare.co.uk’s fixed-rate ISAs for full breakdowns.

Pros and cons of locking in

Pros include rate certainty and higher yields; cons are penalties (up to 180 days’ interest) and opportunity costs if rates rise. Ideal for risk-averse savers comparing ISA fixed rates.

Specialist ISAs: Junior, lifetime, and investment

Beyond cash, compare stocks and shares ISA rates for growth potential, though variable and riskier than 4% cash yields. Junior ISAs average 4% AER, tax-free until adulthood.

Junior ISA rates

Compare junior ISA rates show easy access at 4.00-4.20% AER from providers like Newcastle Building Society. Parents can transfer existing child savings tax-free.

Lifetime ISA bonuses

Lifetime ISAs add a 25% bonus, making effective rates higher than standard cash ISAs; compare lifetime ISA rates carefully for penalties on non-qualifying withdrawals. Over 87,250 were withdrawn for homes in 2024-25 (GOV.UK, 2025).

Stocks and shares comparison

Compare S&S ISA rates involve fund performance, not fixed interest, averaging 5-7% long-term but volatile. For basics, see types of ISA accounts.

Market trends and 2025 outlook

UK savers poured a record £103bn into ISAs in 2023-24, with average values at £34,044 in 2024-25 (sources: The Guardian and GOV.UK, 2025). Expect rates to hover 4-4.5% in 2025 if base rates ease.

Recent inflows and stats

Inflows reflect a ‘dash for cash’ amid allowance cut fears; 15 million new accounts opened recently.

Impact of base rate changes

Bank of England cuts could lower variable rates, favouring fixed; compare ISA rates 2025 monthly.

Tips for maximising returns

Diversify across types, transfer annually, and use the full allowance. Explore best ISA rates for ongoing comparisons.

Frequently asked questions

What is the best cash ISA rate right now?

The top easy access cash ISA rate stands at 4.51% AER as of October 2025, offered by providers like Yorkshire Building Society. This beats many standard savings accounts due to tax-free status, but rates fluctuate with market conditions. For the latest, check comparison sites like Moneyfactscompare.co.uk to ensure you select an option with FSCS protection and no hidden fees.

How do I compare ISA interest rates?

To compare ISA interest rates, use AER as your benchmark and filter by access type, term, and minimum deposit on trusted platforms. Consider your liquidity needs—easy access for flexibility or fixed for security—and factor in the £20,000 allowance. Tools from Moneysavingexpert.com provide eligibility checks, helping avoid unsuitable products.

What are the top fixed rate ISAs for 2025?

Leading fixed rate ISAs for 2025 offer up to 4.27% AER for five-year terms from providers like HSBC and Nationwide. Shorter one-year options sit around 4.00%, providing stability amid potential rate drops. Experts recommend locking in now if you won’t need funds soon, but review penalties for early access.

Are there ISAs for over 60s?

Yes, over 60s can access all standard ISAs, including cash options with competitive rates up to 4.51% AER, often with senior-specific perks like higher allowances in some building societies. Compare ISA rates for over 60s focuses on easy access to maintain income flexibility. These accounts remain tax-free, maximising pensions alongside savings.

How does a Lifetime ISA compare to a standard Cash ISA?

A Lifetime ISA offers a 25% government bonus, boosting effective returns beyond standard cash ISA rates of 4-4.5% AER, but limits withdrawals to first homes or age 60 with penalties otherwise. Standard cash ISAs provide full flexibility without age restrictions, suiting short-term savers. Choose based on goals: LISA for long-term property or retirement, cash for immediate access.

Should I transfer my existing ISA to get better rates?

Transferring ISAs can secure higher rates like 4.51% AER from current 3-4%, done free via providers without losing tax benefits. It’s worthwhile if the new rate exceeds your old by 0.25% net of any bonuses, but check for transfer limits annually. This strategy optimises returns in a falling rate environment projected for 2025.